By Theresa Lyons, SVP-Strategic Planning, The Mars Agency

Note: The following analysis was originally presented as a session at the Path to Purchase Institute’s Shopper Insights & Measurement Forum in September 2021.

As curbside pickup and home delivery of grocery purchases have really taken off in the last year and a half, we started thinking about the possible nuances in behavior that relate to this particular part of the shopping journey.

Before the pandemic happened, marketers spent a lot of time talking about the busy family and how we could make things convenient for them. And I can’t think of anything more convenient than ordering your groceries online and having them delivered to your house or picking them up curbside or in-store. So as we continue to come out of this pandemic and life gets busier again, this is a really important space for us to understand as it continues to evolve.

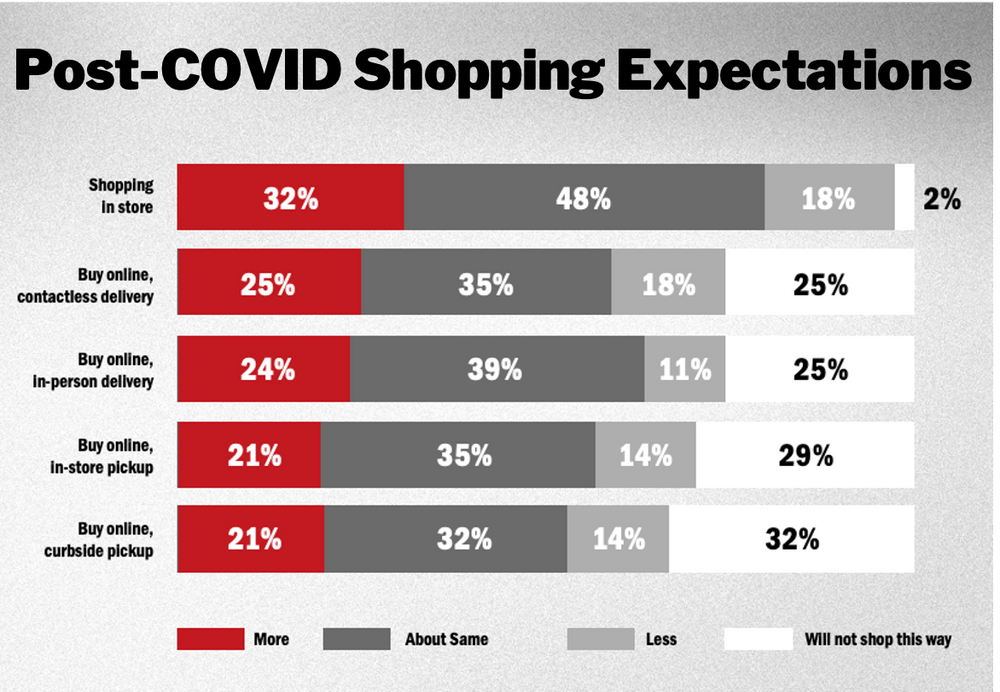

Now even though most grocery shopping is still done in-store, we have seen so much momentum shift over the last year and a half to online. If you’re involved with insights, you know the statistics pretty well by this point, the statistics that show all the growth that we saw in e-commerce within just a few months:

Knowing all that, we started to think about online shopping, which actually means a little bit more than just online activity. It’s about curbside pickup, buy online and pick up in-store, having the order delivered to your house — all the platforms that are evolving today to develop ways for shoppers to get their items more easily and in a much faster period of time — whether that’s an hour or a half an hour. And we’ve seen data where shoppers say, “I’m getting used to this. I kind of like it. I think I’m going to keep doing it once the pandemic is over.

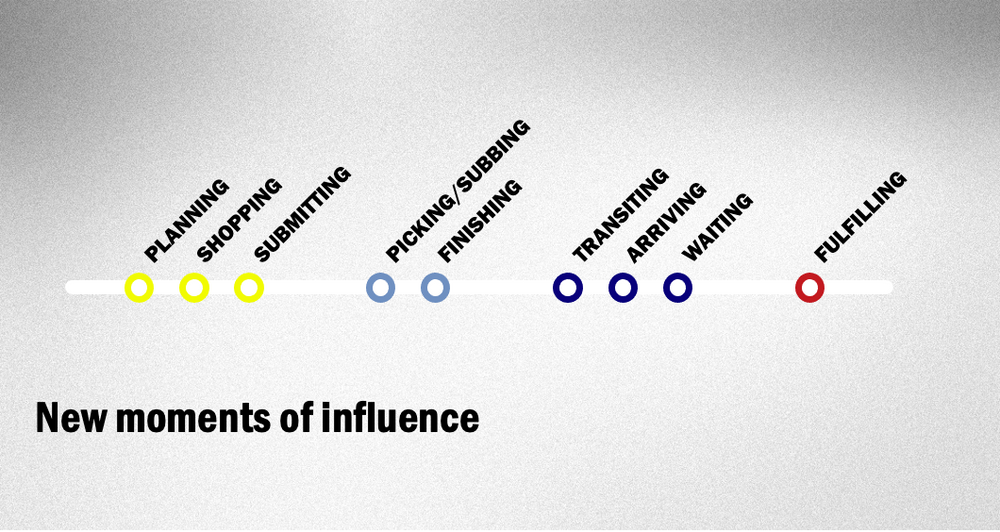

That begs the question: How is this changing shopping behavior? These trips are very different than the traditional in-store trip. So what does that mean for the path to purchase? For a long time, when we looked at the path to purchase, our nomenclature was:

Aware – Shop – Buy – Use

Yours might have been Pre-shop – Shop – Post-shop, but the idea is the same. And we’ve talked for a long time now about the path to purchase no longer being linear, there are on-ramps and off-ramps and critical moments along the way. A lot of different points and a lot of different intricacies in the journey.

But this is a moment in particular where we really need to rethink how all of this relates to these new, different types of trips because in these trips, shoppers don’t actually go pick their own items. They don’t ever walk into the store.

That makes this an inflection point in the journey that isn’t like anything we’ve seen in a really long time, and that makes it really interesting and really exciting at the same time. That makes this an inflection point in the journey that isn’t like anything we’ve seen in a really long time.

In these trips, shoppers doesn’t actually go pick their own items. They don’t ever walk into the store. That makes this an inflection point in the journey that isn’t like anything we’ve seen in a really long time.

When this trip starts, it doesn’t look incredibly different. People still have to plan their trip, which retailer they’re going to and what items they’re going to get. They still have to do the actual shopping, so that that part of the trip looks pretty much the same as elsewhere.

It’s the minute they hit that “Submit” button where things really start to look a lot different. Now you’ve got this moment where, as a shopper, I relinquish selecting my own items. There’s a proxy that takes over. It might be a store employee or an online platform shopper, but somebody else is now picking my items for me.

And it’s interesting to think about that, because if that person is really great at what they’re doing, that could be a great experience — but if they’re not then it could be a little bit of a clunky experience. Either way, that person is now your eyes in the store, communicating with you about what the options are if something you want is out of stock.

And the question here is, do these people represent the next evolution of influencers? Here’s an example from my own experience: I bought my groceries online and them delivered to my house for a year before the pandemic hit. And 90% of the time, the same shopper would fulfill my order. So we would chit-chat a little bit when she was dropping off my groceries, and we got to know each other a little bit. One day, early in the pandemic made a comment like, “I wonder when we’re going to see disinfecting wipes on the shelf again. Weeks later, as she was getting my groceries, she texted me and said, “The store has disinfecting wipes on the shelf today, would you like some?”

So she just influenced an impulse purchase from me. I just made a comment to her, but because she was an excellent shopper, she listened and remembered what I might want and got an impulse purchase out of me. So this could be something we need to think about for the future.

Do in-store pickers represent the next evolution of influencers? This could be something we need to think about for the future.

And the other thing about at this stage is packaging. In-store fulfillment doesn’t just involve walking down the aisles and picking items from the shelf. Some of it is happening in a backroom or a warehouse. Retailers are building micro-fulfillment centers. This is a moment where you might need to think about your packaging: is it simple to be picked? When ecommerce first emerged, we had to rethink packaging in terms of optimal shipping to the home. This now could be another point for us to consider.

What else is different? There’s the transitioning time. These shoppers are either going to the store to get their groceries or somebody is coming to their house with them. If it’s curbside pickup, they get there and notify the store that they’re in the parking lot. They’re waiting for somebody to bring out the groceries.

They’re in the parking lot. They’re waiting for somebody to bring out the groceries. This is a captive moment.

Photo at right courtesy of Path to Purchase Institute

Here at The Mars Agency, we use our Marilyn technology platform to help inform all our understanding about the path to purchase and we’ve just completed a proprietary annual study that fuels our technology now. This year, we knew it was really important to include online grocery such as Instacart, Peapod and Shipt, and also on-demand services like Gopuff, Drizly and DoorDash.

The data is hot off the presses, and we’ll be using it to help us better understand how shoppers are now behaving along the path to purchase, and in particular how that behavior might different across retail channels and even across specific retailers.

In-Store vs. Online Behavior

So the first thing we looked at was, of course, the behavior of in-store shoppers versus online shoppers, and then among that second group comparing behavior between the ones who were going to pick it up at the store or have it delivered. How did those shopping trips look different?

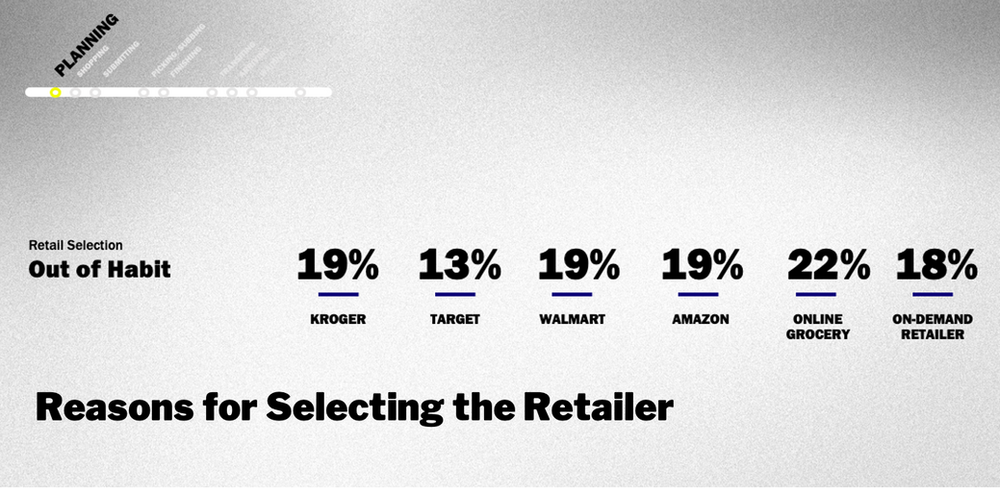

The first thing a shopper has to do is decide where to shop. And for a long time, when we’ve asked shoppers how they choose the retailer, “They’re close to my house” has been one of the factors at the top of the list.

But we found here that proximity fell a little bit farther down the list. And that makes sense if your groceries are going to be delivered because you wouldn’t care how far away the retailer is. But when you think about the people picking up at the store, they now might be more willing to go another five or six minutes down the road to try a different retailer because, at the end of the day, they’re still saving a lot of time on the overall shopping experience. It’s still not taking as long as a trip to the store.

Another reason for retailer selection we’ve heard a lot over the years has been, “Well, that’s the place I always go.” The choice comes out a habit because that’s their store, that’s their retailer. But in this instance, that also fell farther down the list. These are habits that are still forming, so they’re not completely solidified just yet. But what that tells us is, there’s still an opportunity to win these trips, an opportunity to connect with these shoppers.

So then, why are people choosing these retailers? The experience matters more than anything right now. And specifically, the online interface is important to them, and also what other people are saying about the experience in the form of ratings and reviews.

They’ve got to be able to get onto your interface easily and find what they want easily and complete the order without any hassles. And they’re looking at what other shoppers are saying because they want to know: Were they able to get a delivery or a pickup time that was convenient? Did it arrive on time? Was the bread smushed at the bottom of the package? All of those are important for the experience, which is really the most critical thing right now. So we really need to make sure that we’re delivering on these.

Now, once they’ve chosen the store it’s time to plan the trip. And what was different here compared with in-store trips? Shoppers were more likely to compare prices between brands, although they were actually less likely to use coupons. That could be a sign that they haven’t quite figured out yet how to use digital coupons and get them applied to their cards, so maybe it’s just easier for them to compare prices.

And that suggests another opportunity for brands. They are distributing digital coupons, but this might tell us there’s an opportunity to do a better job teaching shoppers how to find them and apply them when planning trips.

They also said they were more likely to look for meal and snack solutions, and were more likely to check for recipes and ingredients for upcoming meals. That might be telling us that, since they’re saving time by not walking through the store, they might be willing to transfer some of that time to this part of the shopping journey. So there’s an opportunity for us to impact them during this period, when they’re thinking about the meals, or the snacks, they’re going to have for the family this week.

On the other hand, we did find that these shoppers were less likely to check the cupboards or the pantry, and this could just be a matter of them realizing they were taking the last jar out and immediately adding it to the cart or putting it on the list. And they were less likely to ask family members if they needed anything. I honestly don’t have a good hypothesis for this, but it’s an interesting to change in behavior to consider.

Behavior at Online Grocery Retailers

We also looked to see if shopping behavior was any different at those pure online retailers, the Instacarts and Peapods of the world, and it really wasn’t. Most behaviors were fairly consistent with what we saw at other retailers. This tells us that the online grocery shopping journey is the online grocery shopping journey, it’s pretty consistent regardless of where they’re shopping.

Now, the shopper is done with the planning and it’s time to start shopping, time to start picking the items to put into their cart. And in this stage, it really becomes all about the navigation.

This makes total sense when you’re going into a physical store, where you use cues all along the way, whether it’s something that you see on the shelf, the displays or the endcaps, there are things that you’re using.

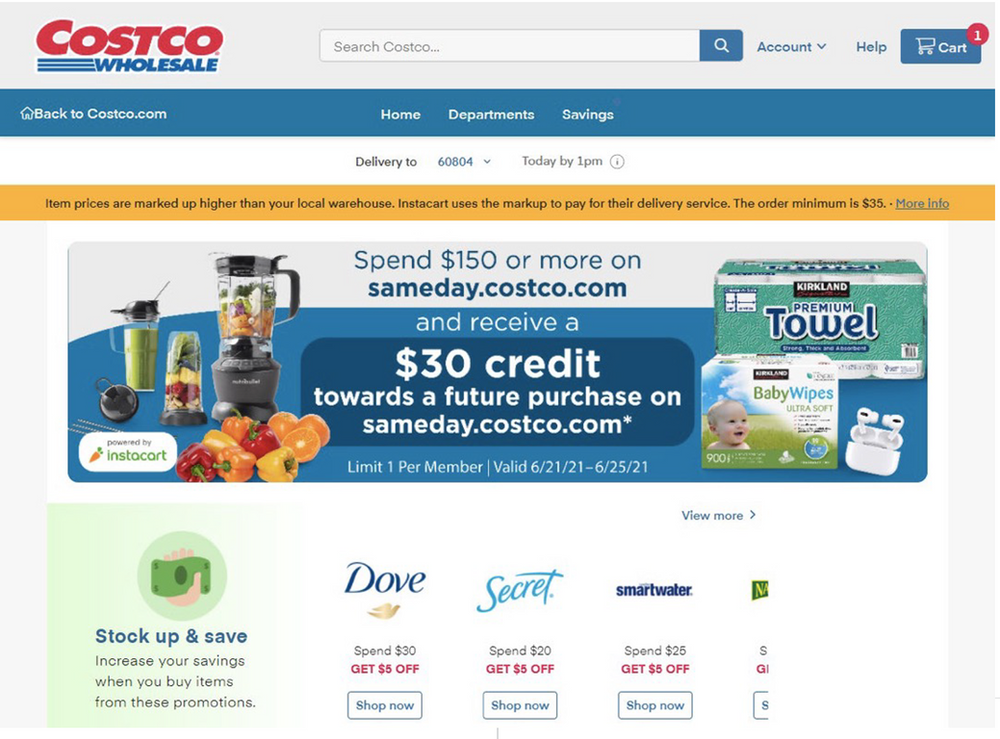

But when you go online to buy your groceries, you have to go in and find those products to get them into your cart. Here, shoppers said they were primarily using the search bar to look for products, using the menus, searching the retailer’s website. And remember this is why they pick a retailer — because of the experience. So this part has to be smooth and it’s got to work for them, because this is the primary way that they’re getting items in the cart.

And the other thing they said that’s really interesting is that they like to get a little inspiration at this point. You know the retailers do a great job of putting different bundled offers out there, and remember shoppers said they’ll spend a little bit more time looking for a meal inspiration. So this is a great place to influence them as they’re shopping online since we’ve lost the ability to drive impulse from displays in the store. This could be the online equivalent. We can create recipes and make them shoppable so it’s easy to add the ingredients to the cart.

But, once you inspire them and get the items into the cart, you’ve got to make sure they feel really good about their decision, because one of the other things they do is delete items from their cart. At the end of your trip, it’s a lot easier to delete an item from your online cart than it is to bring it back to the shelf in-store. It’s also very easy to see ahead of time what your cart totals, which makes it easier for shoppers to decide that they didn’t mean to spend so much and start to second guess some of thir purchases. So here’s a point in the journey where, although you don’t want to pester them, maybe you can offer a suggestion or an alternative to the items they are deleting — like, “Remember that was going to be part of the meal” — or do something to keep from losing that purchase once you’ve worked so hard to get it into the basket.

So now they’ve selected all of the items they want, and this gets us to that interesting part where the shopper relinquishes control to the person who’s doing the picking. And at this stage, shoppers said they want to get what they ordered. That doesn’t seem like a lot to ask, but remember we’ve been dealing with out of stocks for a long time now. So behaviors here really focused on the substitutions.

They want to get really good substitutions that don’t cost them more. And they want to be able to have a dialogue with the picker to hear about out of stocks and get some options about what might be available. In some platforms, that does happen, but in other platforms it doesn’t. If it can, that’s a really important point for shoppers. This is their eyes, the person who’s telling them what else they can get.

So it’s really important to make sure that these people are as savvy as they can be, and that they’re able to make those substitutions and help shoppers get what they wanted out of this shopping trip.

Now, finally, they’re going to the store to pick up what they ordered. And with curbside pickup, we find that there’s still an opportunity to influence basket growth even at the end.

We asked these people if they still went into the store when they picked up the order, and although the vast majority said no. And I know we all want to get them into the store to buy more things, but remember they chose this trip because they don’t want to go into the store.

I know we all want to get them into the store to buy more things, but remember they chose this trip because they don’t want to go into the store. But when we’re bringing the order out, can we ask if there is anything else that we can get for them?

But when they did go into the store, a lot of it simply came down to, “I forgot. I realized when I got there that I forgot something.” So if this is the trip they want, how can we help them overcome this issue. When we’re bringing the order out, can we ask if there is anything else that we can get for them that they might have forgotten. Now I know that can become a logistical nightmare, but are there ways we could do that for certain items?

Or again, if you sell an impulse item, I’m sure you’re thinking about this because they’re not standing in that checkout line anymore, flipping through a magazine. Is there an opportunity here to say, “Great, we’ll be out in a minute with your order. Can we get you a bottle of water or some gum?” Can we get them a magazine or a pinecone air freshener or whatever we put in those aisles? They’re captured at that moment, in that space, is there an opportunity at that time to serve up some content and still inspire incremental purchases?

Impulse Buying on Demand

One final thought, which isn’t really specifically part of the path to purchase but I found really interesting as we started digging deep into the on-demand platforms, is that there’s a lot of opportunity for impulse buying.

Because when we looked at on-demand platform purchases, we found a lot of people shopping between 5:00 and 10:00 at night. And they were more likely to ask their family if they needed anything (where remember earlier we saw that most online shoppers were less likely to do that). And people they were more likely to be looking for meal and snack solutions.

So we should think of these as moments in time: It’s the moment I realized I’m out of diapers at seven o’clock at night. It’s the moment my child got sick and I needed some OTC and wasn’t able to go out to get it. It’s the moment my family decided that we were going to do family movie night and we wanted to liven it up with some fun snacks.

How can your brands fit in there? How do they complement the moment? How do you add value in that diaper moment to say, we have some formula or even a package of cookies; at that OTC moment to say, we can add some soup or some tissues; at that family movie night moment to say, can we add a soda or a bottle of wine? It’s really interesting to think about how we can make these experiences even more valuable and more fun for these shoppers by looking at the dynamics of these moments.

We’ve really just begun digging into our study to see how it can complement what we’re thinking about the path to purchase, and we’ll certainly be presenting a lot more thoughts on this in the coming months. In the meantime, here are a few closing thoughts:

Where might your brand make an impact in some of these new moments?

Think about your brands, your objectives, how you measure success. There are new points in this path to purchase that replace old points. What does that mean for you, how can you influence shoppers and is there a way for you to uniquely impact that?

Think about how to test and learn while these trips are in their infancy.

This feels like a really good time to do some test and learns. Think about some of the things we talked about. These are not solidified behaviors, they continue to evolve, people are still thinking about these new options, so now’s the time throw a couple of things against the wall and see what happens based on what’s important to you, what your success looks like and what you’re trying to achieve.

Rethink how traditional tactics, like influencers or sampling, may work in this new environment.

It’s a time to start rethinking how some of these traditional tactics fit into these new paths to purchase, how do we influence people along the way and what adjustments should we make to those tactics. For us at The Mars Agency, this is all really exciting, it’s a lot of fun and we’re going to continue to analyze these trends through our Marilyn technology in order to help drive success for our clients.

About the Author

Theresa Lyons has been with The Mars Agency for 26 years and currently leads a team of 12 diverse strategists who are dedicated to developing a deep understanding of the “why” behind shopper behavior to deliver insights and strategy that build brands. Theresa has helped develop shopper strategy for many of the agency’s new business wins, as well as for some of its key clients including Campbell Soup, Henkel, Conagra Brands, BlueTriton, Bacardi and Mars Wrigley. She also has been a key contributor to the development and deployment of TMA’s breakthrough Marilyn technology. Reach her at [email protected].

View the original presentation:

https://vimeo.com/640390350/4a3f7537e1

Courtesy of Path to Purchase Institute