By Michella Chiu, The Mars Agency

Walmart’s recently launched TrendGetter program lets shoppers discover and purchase products from a curated selection that they themselves can help create using image recognition technology.

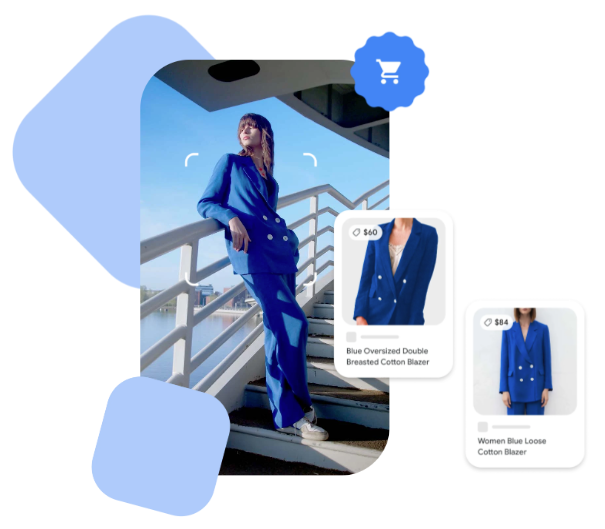

When our team first tested TrendGetter, we found that it had striking similarities to Google Lens (above), a visual search tool that lets users search for products using their smartphone camera.

As it turns out, TrendGetter is integrated with Google Lens, a technology that we predicted last September — when it was still in beta — would become increasingly important to ecommerce. Our prediction was correct.

But while the backend technology is the same, our analysis finds that the TrendGetter and Google Lens services are slightly different in search scope and result priorities, so they potentially can complement rather than compete as ecommerce strategies for different CPG verticals:

Google Lens is good for driving general product awareness. TrendGetter positions Walmart as a final checkout destination.

With TrendGetter, shoppers who scan a product are taken to a Walmart.com product page, where they can make a purchase (watch a visual walk-through below). In essence, Walmart is now leveraging the power of image search to improve discoverability and drive more sales.

https://video.wixstatic.com/video/a97a53_298468440a2c4fe9b67f5312cead3a3f/1080p/mp4/file.mp4

While providing the technology behind TrendGetter, Google Lens on its own plays a completely different role in ecommerce. Since it utilizes the universal Google search function, Google Lens gives users access to information — including reviews — from the Product Detail Pages of various retailers.

However, our analysis finds that the Google algorithm sometimes prioritizes external blog posts and commentaries in search results rather than content from retailer websites. Therefore, the results generated by a Google Lens search could have a major impact on your engagement potential, based on your product’s reputation among online shoppers and connoisseurs.

Here’s another point to consider: With both Google Lens and Walmart TrendGetter, shoppers can refine their searches by color, brand, or visual attributes. This suggests that the distinction between “search” and “browse” is blurring, which makes it even more important for brands to submit accurate product attributes to all their supplier portals.

Taking action to engage shoppers

As technology like this continues to evolve, there are actions brands can take to increase the visibility of their products on search engines. The lowest-hanging fruit is making sure all images contain the alt text needed to make them “visible” to search algorithms.

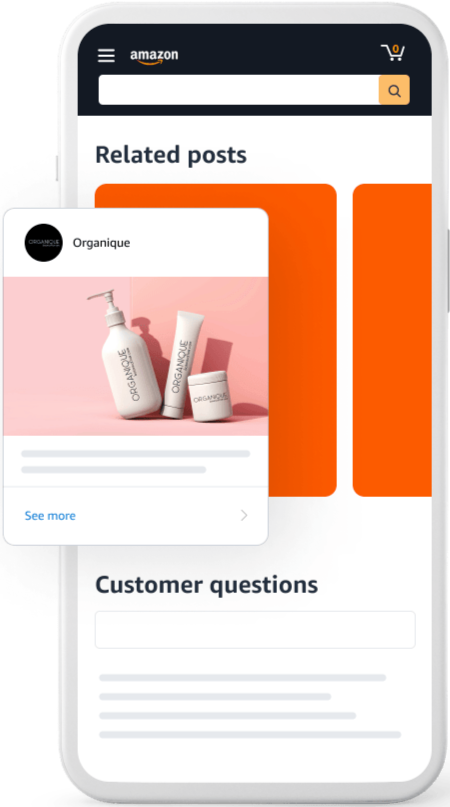

If your Brand Store is using Amazon Posts (the new social media-style feed of product-related content) to showcase products, make sure to use the 2,200 characters allowed in the caption space to tell your brand story, employing relevant keywords to reiterate key product benefits. We’ve even seen more-creative brands include shopper testimonials in this space.

To address the broader search results generated by Google Lens, audit and monitor how various sources might be influencing the reputation of your brands and products, and consider using that information to proactively address any shopper questions or concerns you uncover in the Q&A sections of retailer websites.

Finally, as a test on Walmart TrendGetter, upload a product photo to see what keywords are automatically generated into the search bar. You may be surprised by some of the contextual or backend keywords to which your products are linked. Then, apply these keywords to the backend of PDPs on the retailer’s website to see if it has a positive impact on your seller rankings.

Looking ahead in ecommerce

Google Lens and Walmart TrendGetter are the latest proof point that visualization is becoming more and more important for driving ecommerce success. It will play a key role in driving customer loyalty and stickiness, even among the shoppers that have returned to physical stores — who are still pulling out their phones to find information online as they walk the aisles.

In fact, the next generation of visualization will, in part, seek to recreate the in-store experience by helping shoppers virtually “see” and “touch” products for themselves. Virtual photography studio Nfinite finds that 42% of Gen Z shoppers (along with 30% of Baby Boomers) are more likely to purchase a product if they have an opportunity to “try it” through advanced visualization tools such as augmented reality — and Gen Z is a demographic group that many brands are struggling to win over.

This is higher-hanging fruit, however. If your brand isn’t ready for the next generation of visualization that AR/VR technology will deliver, start now by getting the basics right: 75% of digital shoppers will return a product if it doesn’t match the image they saw when making the purchase online. So make sure that your virtual image always matches the real thing.

About the Author

Michella Chiu is Director of Ecommerce Strategy at The Mars Agency, where she uses her background in marketing and academic research to lead global ecommerce strategy, activation, and program management for clients such as LEGO, Delicato and Johnson & Johnson. Her core functions include catalog support, operations, content development & optimization, and analytics. She can be reached at [email protected].

The Mars Agency’s Ecommerce team knows that succeeding in online marketplaces — Amazon especially — takes more than just winning the algorithm. Powered by the agency’s proprietary data analytics platform, our experts take clients to a new level by providing end-to-end Amazon management, including business operations, advertising, and digital shelf optimization. Our Digital Shelf Studio uses this proprietary data to create, enhance and optimize client activity across the retailer.com landscape to align retailer-specific requirements, be discoverable along the shopper journey, win against the competition, align to brand priorities and initiatives, and convert shoppers.