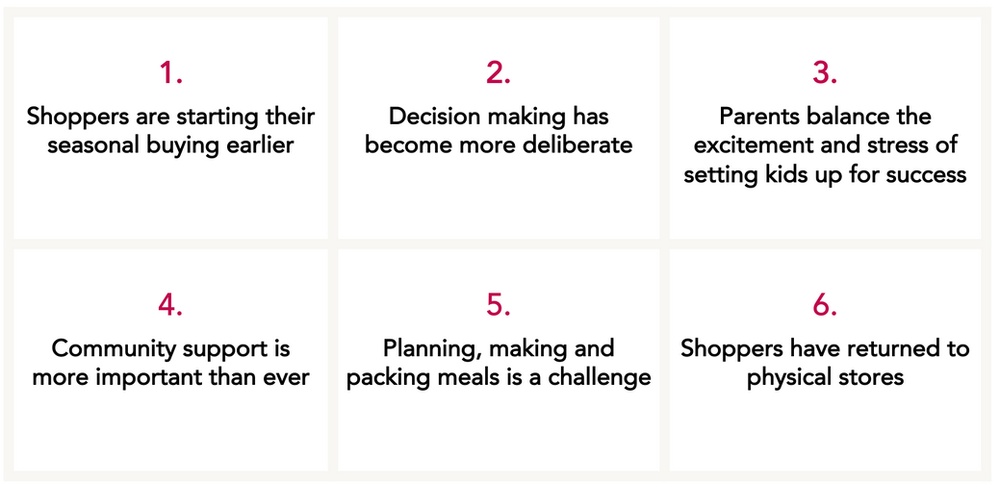

Six shopper trends that retailers should consider when building this year’s seasonal marketing plan

By Katherine Barks, The Mars Agency

Back-to-school shoppers in 2023 will probably be picking math as their favorite subject again.

With inflation continuing to spark a great deal of economic uncertainty, 37% of shoppers headed into the 2022 back to school season expecting to spend more than did the previous year — with a staggering 77% vowing to switch brands if prices were too high.

Nonetheless, seasonal spending grew by roughly 6% to $34.4 billion last year, according to Deloitte estimates. Why? Because despite their financial concerns, parents are still willing to spend whatever it takes to get their children the items they need for success at school — in fact, 38% told the National Retail Federation they’d simply cut back on purchases in other areas to compensate.

According to the NRF’s annual back to school survey, 64% of consumers planned to build their seasonal shopping around retailer sales events, 43% expected to do more comparative shopping online (up from 30% in 2021), and 35% were ready to seek out less-expensive generic brands when possible (up from 27%).

With last year’s economic uncertainty forecast to continue for at least the foreseeable future, back-to-school shoppers in 2023 are expected to keep exhibiting many of these same money-saving behaviors.

The goal for retailers, then, should be to work with supplier partners to give shoppers relevant, affordable solutions that will be as good for their kids’ success in the classroom as they are for their wallets.

Price and affordability aren’t the only factors that will be influencing shoppers this back-to-school season, however. The following report looks at 6 shopper trends and behaviors that retailers and suppliers should consider when planning their seasonal strategy.

____________

1. Shoppers are starting much earlier

Although the summer months still draw the heaviest activity, the back-to-school season now spans six months or even longer as many shoppers are:

- buying early to avoid the pandemic-driven product supply issues of recent years.

- taking advantage of sales events whenever they may occur.

- trying to spread out their expenses over a longer period of time.

Actionable Idea: Develop always-on programs that will provide inspiration with “food for learning” solutions.

____________

2. Decision Making Has Become More Deliberate

Back-to-school shopping is a stressful occasion for many parents, especially given their current spending concerns, and they’re responding by becoming more deliberate decision-makers. They’re prioritizing value and showing a greater willingness to seek out —and wait for — the best deals.

They’re also more often creating lists of the items they need to be better prepared to capitalize on sales events as they arise and take advantage of one-stop shopping: 82% of shoppers prepare a list before heading to the physical store, according to Inmar Intelligence.

Actionable Idea: Don’t make shoppers wait for deals. Present weekly value-based meal/food solutions for lunches, snacks, and on-the-go eating.

____________

3. Parents balance excitement and stress in setting kids up for success

Preparing a child for success is a daunting task, and parents often find themselves excited about the opportunity to help their child succeed but stressed about making the wrong decisions. That makes purchase decisions even tougher: 82% of parents told Mintel that buying the right items is “crucial for my child’s success.”

Meanwhile, children have more influence over their parents’ BTS purchase decisions than during any other shopping season: 85% of parents view BTS shopping as a bonding opportunity, and 81% say they let their kids choose most of the items.

Actionable Idea: Create planning tools that will help parents and kids collaborate on making their shopping lists.

____________

4. Community support is more important than ever

Consumers are making stronger calls for authenticity, inclusivity, and community-based support from retailers and brands. Those expectations are even expressed in functional amenities, like the request for retailers to post local school supply lists on their websites.

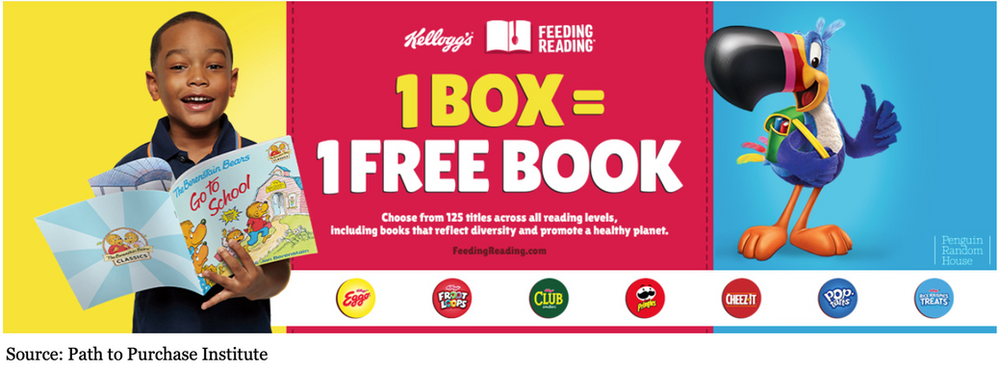

That’s leading a growing number of retailers to increase their support of the community at large through charitable programs that provide assistance to teachers, students, and/or schools in some way.

In particular, retailers are focusing more promotional efforts on helping teachers help students through special discounts, wish list programs for necessary school supplies, and meal programs providing assistance to the 9 million children in the U.S. dealing with food insecurity.

Actionable Idea: Create and amplify community-focused promotional programs that let shoppers support local schools/classrooms through their purchases — without any extra effort on their part — and especially consider programs that will bring food to kids in need.

____________

5. Planning school meals is a challenge

Parents of school-age children spend a lot of time at the kitchen counter: 78% pack a lunch at least once per week, and 53% do it three days or more; 80% at least pack snacks, according to Inmar Intelligence.

More than 40% of these parents spend between $50 and $100 on weekly lunches and snacks, which is why 55% consider coupons, rebates and other promotions to be a very important factor in deciding what products to buy.

One more important data point from Inmar: 45% of parents consider planning, making and packing lunches, snacks and after-school meals to be a challenge. And people with challenges often appreciate some guidance.

Actionable Idea: Make lunch preparation easier with proactive planning tools. Create a content calendar that delivers inspiration across social media platforms, where many parents are heading to find ideas; enable and reward easy sharing among shoppers and their friends.

____________

6. Parents have returned to physical stores

In-store shopping was expected to garner 49% of back-to-school sales in 2022 (versus 43% in 2021), when 42% of consumers told Deloitte they would only shop in physical locations (vs. 17% who would do it all online). That share of seasonal sales will likely increase again in 2023.

So while ecommerce is still critical for seasonal success, in-store marketing should be back on the priority list as well.

Actionable Idea: Drive traffic to stores with advance previews of the back-to-school items that will be available. In the store, capture the attention of parents with prominent seasonal merchandising and promotions that address the five other trends discussed in this report.

____________

About the Author

Katherine Barks is VP-Strategy within the Retail Solutions team at The Mars Agency. She is a business strategist with 25+ years of diverse experience across the many facets of strategy, including consumer/shopper behavior research, channel and category insight, retail strategy, customer experience design, and measurement best practice. In her current role, Katherine is focused on supporting retail strategists and retailer clients including Sprouts Farmers Market, Walmart Canada, and Hudson’s Bay.