As the preeminent experts in connected commerce with a specialty practice dedicated to maximizing brand performance across the Amazon ecosystem, The Mars Agency is ideally suited to help brands optimize these opportunities. Each month, our Ecommerce team compiles a Marketplace Assessment to help clients identify the potential business opportunities arising from Amazon’s own initiatives. The following article represents highlights from their latest reports.

Large and in Charge of Ecommerce

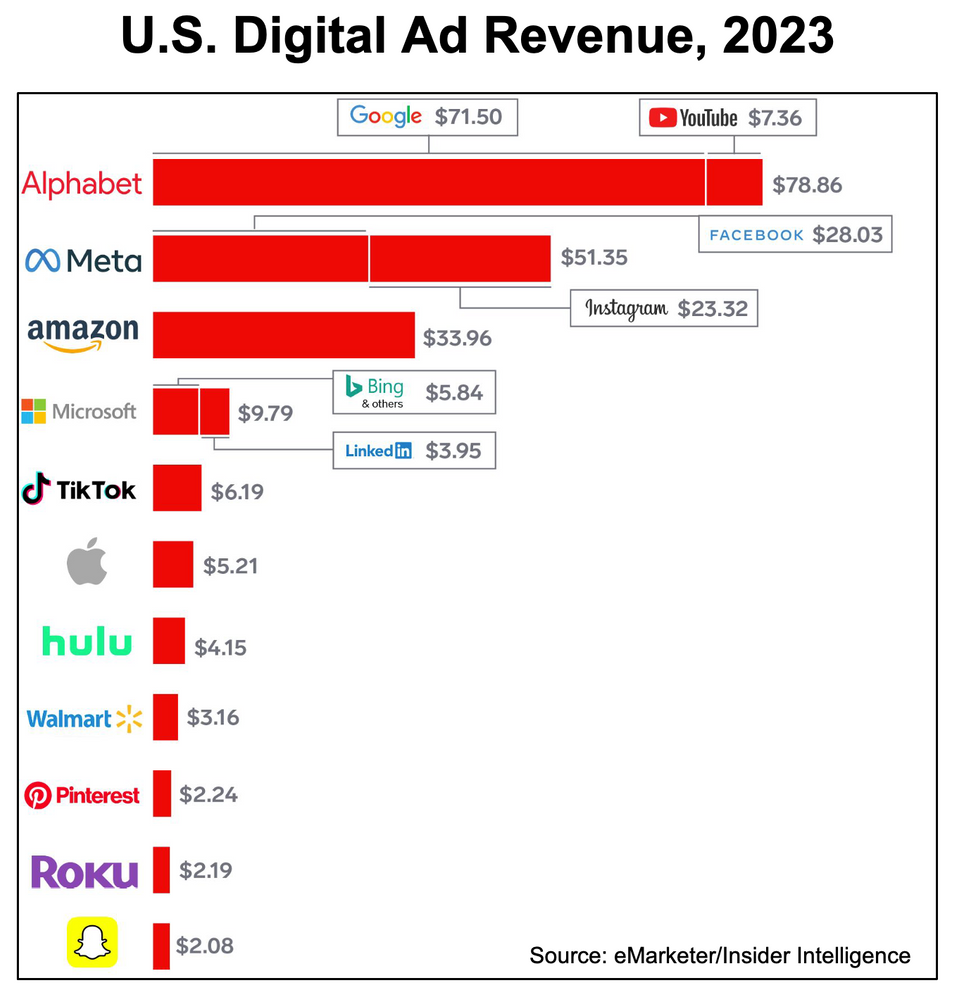

The Story: Amazon’s share of U.S. digital ad revenue continues to increase, apparently at the expense of the Google and Meta“duopoly”: market share for both advertising powerhouses have declined through the first half of 2023, according to eMarketer’s forecast.

Relevance: Amazon is the clear winner in the space, accounting for 37.6% of total U.S. retail ecommerce sales so far this year and 76.2% of all retail digital ad revenue, according to eMarketer (see chart). Its closest competitor, Walmart, accounts for just 6.4% of U.S. ecomm sales and trails in the digital ad department by more than $30 billion ($33.96 billion to $3.16 billion), eMarketer finds.

Amazon’s dominance in the first area contributes to the other, naturally. And the impact it has on product sales beyond its own websites is well documented, positioning Amazon as a legitimate media platform. (That’s why Walmart is now working to measure the “rest of market” impact of its retail media.) What’s more, the Amazon Prime Video and Freevee platforms provide valuable target audiences, and Fire TV and Alexa offer advertisers a central point for engaging with other media — and shoppable ads.

Opportunity: As the retail media marketplace continues to grow, Amazon retains a distinct advantage over Walmart and other traditional retailers. One area where Amazon could be seen as lagging other retailers is the potential to extend advertising opportunities into physical stores — something that CPG advertisers have been seeking. Amazon’s Whole Foods chain is more a niche retailer than a mainstream grocer, and the Amazon Fresh store base (44 locations) doesn’t have the necessary scale. That, however, could soon be changing based on recent news about the company’s plans to completely overhaul the grocery business (see below).

Regardless of its future plans, Amazon’s strength as both the leading ecommerce destination and as a highly influential, sales-driving media platform basically makes it a “must buy” in any brand’s media plan.

Grocery Is Back on the Front Burner

The Story: In what Bloomberg called the “biggest overhaul of its grocery business” in six years, Amazon will undertake a sweeping series of strategic initiatives across all relevant platforms: renovating, expanding inventory and infusing more technology into physical stores; testing warehouse automation; uniting the grocery shopping environments of Amazon.com, Amazon Fresh and Whole Foods into a single shopping cart — even opening fresh food delivery to non-Prime members.

Relevance: Expected to roll out over the next few months, the moves reflect Amazon’s latest effort to make stronger inroads into the grocery marketplace. Amazon’s previous efforts in the grocery space have been bumpy, and while not a total failure certainly haven’t equaled its market-dominance in so many other areas.

Claire Peters, worldwide vice president of Amazon Fresh and former executive at Woolworths, Australia’s leading grocer, told Bloomberg that that the company’s goal is “to build a best-in-class grocery shopping experience … We’re always looking for more ways to make grocery shopping easy, fast, and affordable for all of our customers.”

Simply saving customers from having to order organic, fresh and shelf-stable items from three separate websites — to be delivered in three shipments — will greatly improve the current shopping experience. Aligning the offerings, which will involve combining inventories in warehouses, might not happen until 2024, Bloomberg notes.

Opportunity: “The world doesn’t need another standardized, big-box grocer. We’re inventing the new because we want to do it differently,” Tony Hoggett, the former Tesco Chief Strategy & Innovation Officer who first joined Amazon in 2022 as SVP Worldwide Grocery Stores, told The Grocer.

Amazon has never been shy about investing in innovation, and many of the tools and technologies that are now considered basic elements of the ecommerce experience were introduced on Amazon.com. If the retailer can find the right formula to win at grocery the way it has elsewhere, CPG brands will need to devote even more time and attention to Amazon than ever before. But succeed or fail, these initiatives should deliver plenty of test & learn opportunities as Amazon works to reinvent the grocery shopping experience.

Making Search Even Easier

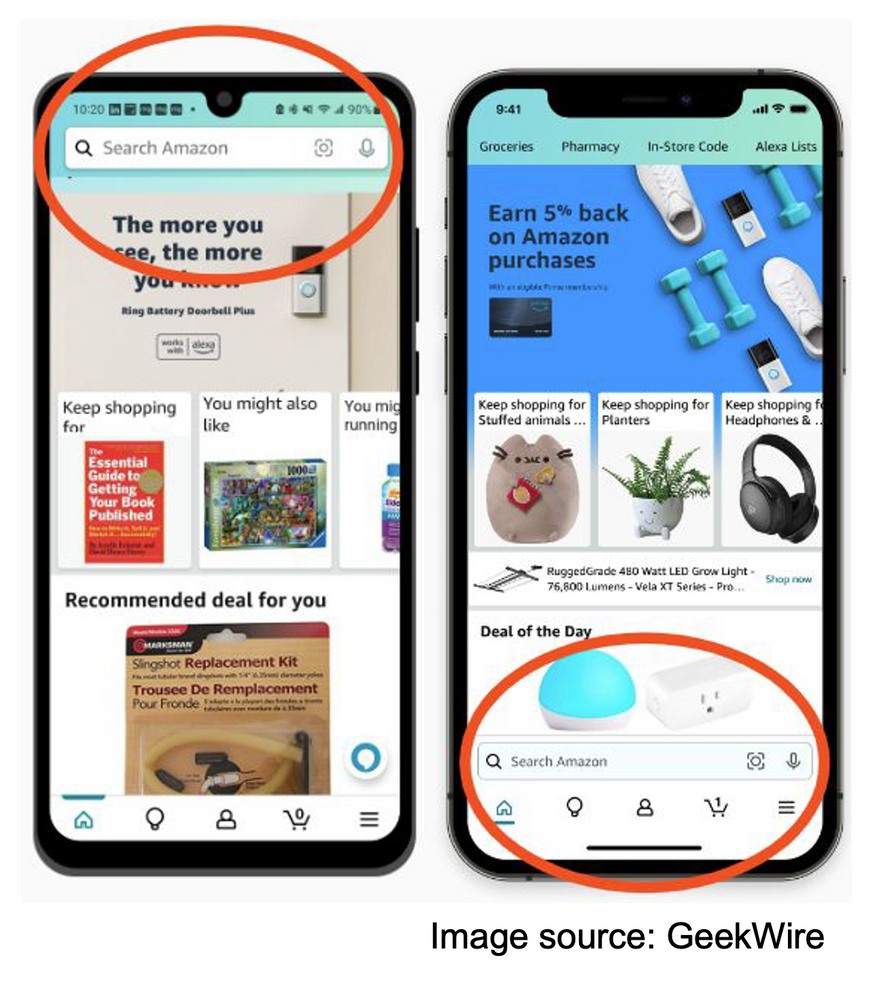

The Story: Amazon is testing a reconfiguration of its mobile app, moving the search box from the top of the screen to the bottom and locking the bar in place as users scroll down the page. The changes will make it even easier for consumers to search, even when they’re only using one hand. The test started in early June and was expected to steadily roll out to more users worldwide.

Relevance: This is a notable design change that reflects Amazon’s ongoing efforts to remove any and all barriers to the shopping experience on its app and across all its platforms.

Opportunity: Although brands don’t have any control over Amazon’s UX (user experience), it’s important for them to test & learn with any new features and functions that roll out to evaluate their impact on shoppers and shopping.

Seller Fulfilled Prime Returns

The Story: The Seller Fulfilled Prime program lets brands and other third-party sellers receive a Prime Badge on their listings even when fulfilling purchases directly — provided they meet a strict set of requirements. Although the program first launched in 2015, new enrollments were paused in 2019 after Amazon noticed a decline in the “high-quality experience that customers expect from Prime.” Amazon recently announced that enrollments will re-open in the coming months with an improved customer experience; the retailer later revealed that it will take a 2% cut of every product sold.

Relevance: Obtaining a Prime Badge for your product listing can increase discoverability and Buy Box ownership, improving access to those 150 million Amazon Prime members. Previously, 3P sellers were required to utilize Amazon’s costly fulfillment program to earn a Prime Badge.

Opportunity: Brands with direct-to-consumer fulfillment capabilities should consider using this option to leverage these better connections to Prime members — especially since 3P Sellers are able to control their own pricing and inventory. Account health and strong performance metrics are necessary to qualify for the program so should be managed appropriately.

____________

To obtain a complete copy of our latest Marketplace Assessment or learn more about how The Mars Agency can help you win at Amazon, contact Melissa Wightman, VP-Ecommerce, at [email protected].