The Mars Agency presents a simple game plan for retailers looking to build loyalty among inflation-focused shoppers.

By Katherine Barks

Steady inflation and ongoing economic uncertainty have sparked anxiety levels among shoppers that haven’t been seen since the start of the pandemic: 94% of consumers are worried about inflation, according to Mintel.

More than half of U.S. consumers (56%) don’t consider themselves to be financially healthy at the moment, and nearly one-third (31%) of U.S. parents say they’re struggling to keep up with day-to-day expenses. Inflation is affecting them across a variety of commodities, including rent, fuel and other living expenses in addition to food and other household goods.

As costs continue to rise, shoppers are naturally making changes to their buying behavior: 59% are prioritizing price over product quality, and 62% are choosing price over convenience, according to Mintel. And most concerning to retailers should be this statistic: a whopping 96% of consumers intend to adopt cost-saving behaviors in the near future, according to a recent PWC survey.

At retail in general, 40% of shoppers are sticking to a strict budget, 33% are reducing impulse purchases and 28% are simply buying less, PWC finds. At the grocery store in particular, 30% are buying fewer items, 34% are shopping value stores more often, 61% are stocking up on private label options and 72% are searching for deals more often than before.

Having a stable plan during times of economic anxiety is important to these shoppers, which leaves little room for trying new items or buying premium brands. Empowered by technology, they’re seeking seamless in-store and online experiences that better suit their lifestyles — and their wallets.

Action Item:

Lower prices are 4 times more likely

to attract shoppers than store promotions.

Source: FMI

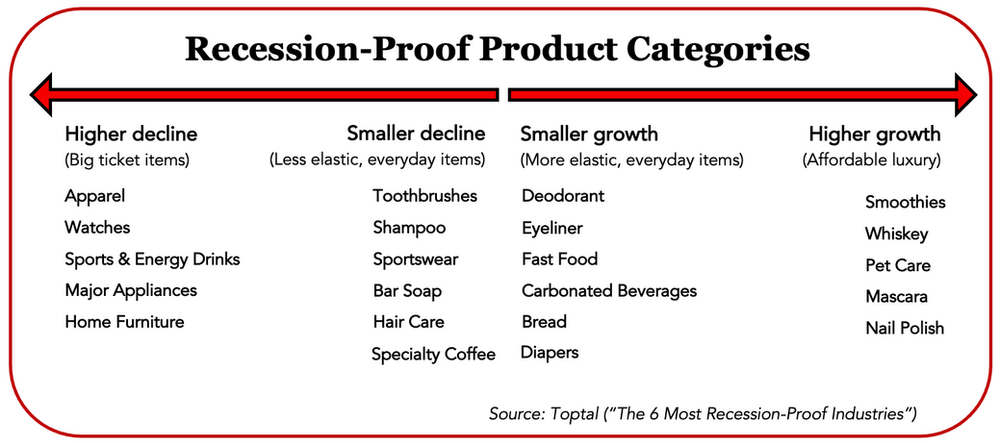

Despite all the budgeting, however, some product categories that are typically viewed as non-essential have remained recession-proof. It’s a phenomenon that has long been known as “the lipstick effect,” referring to the fact that sales of the common beauty product are often inversely related to the economic climate.

This gives both premium and value brands an opportunity to gain (or at least maintain) share by showing how their products can make a daily routine more affordable while still providing some level of indulgence. (More on that later.)

This willingness — or perhaps even need — among consumers to make some exceptions to their inflation-inspired budgeting plays out in other ways as well: More than 70% of shoppers, for instance, told PWC that “to some or to a great extent” they’re willing to pay more for food produced by local farmers and goods made by companies known for ethical practices like supporting human rights or avoiding animal testing. (More on this later, too.)

What’s Can Retailers Do?

As a result of these changes in shopper behavior, retailers as well as brands need to modify their shopper engagement strategy. Preparation is vital, even for product categories that normally perform well in difficult economic times.

The Mars Agency has compiled the following game plan of ways that marketers can adapt their tactics and messages to reach today’s inflation-anxious shoppers.

1. Amplify Affordable Quality

Demonstrate value by offering curated solutions that can also deliver on the promise of quality and affordability:

Curation: Make it easy for shoppers to put together meals without requiring extra work on their part.

Quality: Provide transparency into both your product sourcing practices and any quality guarantees you make.

Price Assurance: Provide easy ways for shoppers to compare your prices with those at other retailers.

2. Amplify Empathy

Make shoppers feel welcome, supported and understood. Enable store associates to deliver locally relevant solutions across a range of budget levels to meet the needs of all shoppers:

- Offer high level of personal service.

- Make it easy to buy local brands.

- Curate solutions based on local tastes.

Another idea: Amplify affordable indulgences, as discussed earlier. Target shoppers who’ve cut back on their favorite luxuries with ideas for small, affordable alternatives in beauty, bakery, flowers, or even ice cream.

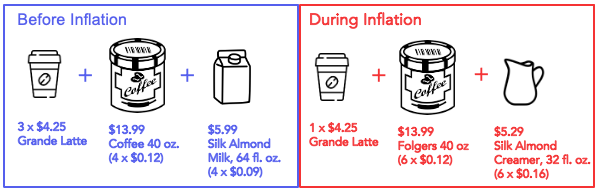

As one example, consider a typical consumer’s daily coffee routine:

Before inflation, 3 premium lattes “on the go” from a coffee shop and 4 basic coffees made at home might cost $13.32 per week. During inflation, consumers might be persuaded to switch to 1 premium latte on the go and 6 slightly fancier coffees at home for a weekly cost of $5.93 per week and savings of $7.39. The coffee shop’s loss is the grocer’s gain, with the price-conscious shopper being the big winner.

3. Amplify Rewards

Build repeat trips from shoppers by rewarding them in the ways they need most — surprise them with savings on their next trip.

- Give them opportunities for trial and product experience.

- Leverage purchase history to retarget them with relevant category offers.

- Deliver surprise offers when they’re in proximity to stores.

Another idea: Create regular, ritualized promotions that leverage existing campaigns — like weekly, traffic-driving doorbusters that will have shoppers anticipating the next offer.

Developing an effective plan of attack to address the needs of shoppers during this time of economic uncertainty may have longer-term benefits as well, because it appears that some of the habits they’ve adopted may stick.

In fact, 90% of shoppers recently told FMI (Food Marketing Institute) that they plan to continue bargain hunting in the future, and 40% said they will continue visiting multiple stores to find the best deals. What’s more, 73% said they’ll keep buying the private label products they’ve grown to like, a good sign for the retailers they’re currently shopping (although not such good news for national brands).

So the value, quality, empathy and rewards that retailers communicate today could ultimately keep shoppers coming back long after the economy improves and their anxiety subsides.

____________

About the Author

Katherine Barks is VP-Strategy within the Retail Solutions team at The Mars Agency. She is a business strategist with 25+ years of diverse experience across the many facets of strategy, including consumer/shopper behavior research, channel and category insight, retail strategy, customer experience design, and measurement best practice. In her current role, Katherine is focused on supporting retail strategists and retailer clients including Sprouts Farmers Market, Walmart Canada, and Hudson’s Bay.