To keep the industry updated between the quarterly editions of our Retail Media Report Card, The Mars Agency is monitoring the efforts at leading platforms to improve and expand their capabilities and services.

We’re focusing on the initiatives these networks are undertaking to make it easier and more efficient for advertisers to effectively plan, execute and measure their marketing programs. In particular, we’ll be tracking changes that impact the 62 key performance criteria on which the platforms are evaluated within the Report Card.

The information covered in these updates will be used by Commerce Media analysts to inform the network evaluations that will be presented in future editions of the Report Card.

____________

Amazon Advertising

Enhancements: While hosting its annual unBoxed event last month in New York, Amazon unveiled several exciting new ad formats, capabilities and tech enhancements. The Mars Agency’s Kelly McLane provides a rundown of 9 additions and enhancements that caught her attention.

Advertising is an important revenue stream — and profit generator — for Amazon, especially now as it tries to offset slowing ecommerce growth and ballooning operating costs.

By updating and expanding the ad opportunities available on its platform, as well as the brands that can access them, Amazon is seeking to maintain its leadership position in the retail media space as Walmart, Target, Kroger and other platform operators continue to make more headway. Innovating on advertising opportunities and related services should remain a priority even as the company undertakes a significant workforce reduction.

Brands should always consider kicking the tires on new ad offerings at Amazon, the leading online launchpad for product searches and a critical influence on purchases that are ultimately made across the entire retail ecosystem.

____________

Kroger Precision Marketing (KPM)

Enhancement: Kroger Precision Marketing (KPM) has expanded the programmatic private marketplace it launched in 2021 to include video and connected TV (CTV). Brand and agency advertisers can now use the retailer’s first-party sales data to target campaigns through inventory suppliers such as Magnite, OpenX, PubMatic and Xandr.

Suppliers now have access to KPM’s rich audience intelligence to reach relevant CTV households with their customized video programming, and then measurement performance against attributable sales and household penetration. The move comes as the traditional TV audience continues moving toward streaming video, which offers a greater opportunity for commerce marketing.

“Our expansion into CTV and video demonstrates how retail media is driving greater accountability across the entire media supply chain,” said Cara Pratt, KPM’s SVP. “We’re proud to be working closely with brands and agencies as we make their programmatic advertising investments more effective and efficient.”

Soon after, KPM announced a partnership with Snapchat to likewise make its first-party shopper data available for targeted campaigns through the social platform, which claims 75% of U.S. consumers aged 13-34 among its users.

Enhancement: KPM improved the user experience behind Targeted Onsite Ads by adding functionality that lets shoppers click through to a curated product list.

This improved functionality creates a more seamless user experience but also could potentially increase conversion rates by putting shoppers even closer to the advertised products. Brands should work with KPM to determine the best ways to leverage this enhanced functionality.

____________

Walmart Connect

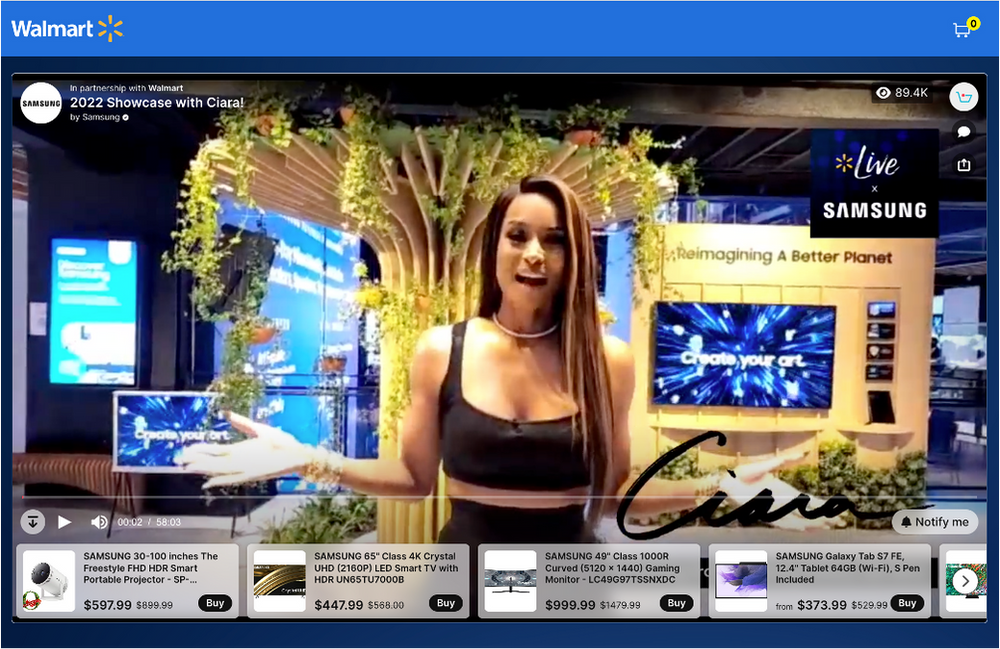

Enhancement: Walmart Connect significantly expanded the multi-media opportunities it offers suppliers beyond its internal assets by entering into advertising partnerships with:

- Social media networks TikTok and Snapchat.

- Video streaming service Roku Inc.

- Livestream shopping services Firework and TalkShopLive.

These new partnerships will provide a variety of opportunities for suppliers, and particularly will open the door for test & learn activity as new advertising tools begin to roll out.

Enhancement: Walmart Connect also expanded its Search Brand Amplifier self-service tool to all sellers that are registered with Walmart’s Brand Portal. The tool lets brands obtain higher visibility for their products by boosting advertised items to the top of search results.

Search Brand Amplifier was previously limited to only managed sellers and a limited number of suppliers. The expansion will therefore benefit newer and/or smaller brands that haven’t yet achieved high organic listings on Walmart.com, the retailer said.

Advertisers will be able to manage programs through the Walmart Ad Center self-serve platform — which itself has been streamlined to reduce the enrollment timeline for Sponsored Product campaigns from three days to seconds, according to the company.

____________

Best Buy Ads

Enhancement: Best Buy has signed a deal with DoubleVerify to provide “robust” independent measurement tools for ad campaigns conducted by brand partners and the retailer itself.

Best Buy advertisers can use DoubleVerify to gain transparency into both pre-campaign activation (authentic brand suitability, fraud/SIVT) and post-bid filtering and measurement. “Our solutions will support Best Buy and its retail media clients, improving overall ad effectiveness, while giving them greater clarity and confidence in their digital investments,” said DoubleVerify CEO Mark Zagorski.

Enhancement: Best Buy also launched a new partnership that lets advertisers in the U.S. and Canada buy Sponsored Product ads on BestBuy.com through the cross-retailer self-service platform operated by Criteo.

“By joining Criteo’s retail media platform, we’ll be able to better serve our customers with relevant content we know they’re looking for when shopping online,” said Frank Crowson, Best Buy’s Chief Marketing Officer. Criteo, which has been working with Best Buy since 2015, attests that its AI-driven tools ensure that “retail media ads conform to the same targeting and personalization as retailers’ organic product placements.”

____________

Albertsons Media Collective

Enhancement: Albertsons and partner The Trade Desk recently introduced functionality enabling brands to use the retailer’s shopper data for audience targeting across the open Internet, and in the fourth quarter of 2022 will begin measuring the sales impact of all media purchased through the platform (including Connected TV).

“We are really getting to a good place when you can start to bring these kinds of audiences and this kind of measurement to television,” said Kristi Argyilan, SVP-Retail Media at Albertsons Companies, while speaking last week at Advertising Week in New York.

“Imagine targeting an audience of people who are buying allergy medicine at this time of year versus [a traditional media audience of] women 25-54. It gets so much richer — and then we can measure that we actually drove the sale,” said Argyilan.“

____________

DoorDash Advertising

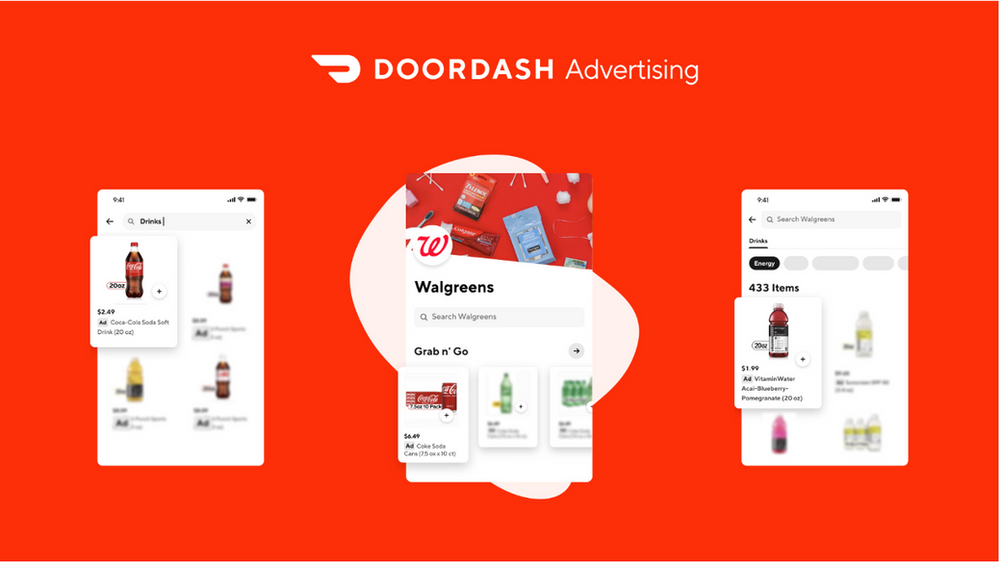

DoorDash is now making ad inventory available for brands of any size through its internal self-serve platform, 3rd-party platforms (like Pacvue or Flywheel), or direct API integration, the company announced at Advertising Week last month.

DoorDash has sold $3 billion worth of advertised products since launching its retail media network in fall 2021, VP of Ads Toby Espinosa said at the event.

____________

Roundel

Also at Advertising Week, Target’s Roundel pledged to continue building up the capabilities of its new Kiosk analytics platform until it can provide closed loop reporting for “every single media offering” available through its platform, according to Matt Drzewicki, VP-Partner Solutions Group.

The goal is “to better understand ecommerce movement but, more importantly, what’s actually happening in the store as well,” he said, while also promising greater collaboration between Roundel and Target’s merchandising and marketing enterprises.

____________

Gopuff

Gopuff Ads joined with partner CitrusAd, powered by Epsilon to add off-site ad opportunities including display, video and connected TV to its existing on-site offerings, “enabling brands to reach not only Gopuff site visitors, but also the entirety of Gopuff’s shopper audience across the open web with timely and relevant advertising,” according to the companies.

The “instant ad platform,” as Gopuff describes itself, has also expanded on-site ad inventory beyond sponsored products and search to include relevant sponsored product carousels.

____________

Elsewhere in Retail Media …

Sam’s Club unveiled a first-to-market API integration that lets advertisers use Pacvue’s self-service platform to manage Search and Sponsored Product programs on the retailer’s Member Access Platform (MAP). A leader in ecommerce optimization tools, Pacvue will help Sam’s Club build up the programming and insights capabilities for MAP, whose June launch makes it a relative latecomer to the retail media marketplace.

“Search is such a key part of the member shopping experience, and through this first-to-market partnership with Pacvue, we are able to extend this member-centric experience to our brand partners as we continue on our mission to make our self-service platform and sponsored product advertisements easy to buy, easy to sell and easy to operate,” said Austin Leonard, Head of Sales for Sam’s Club MAP.

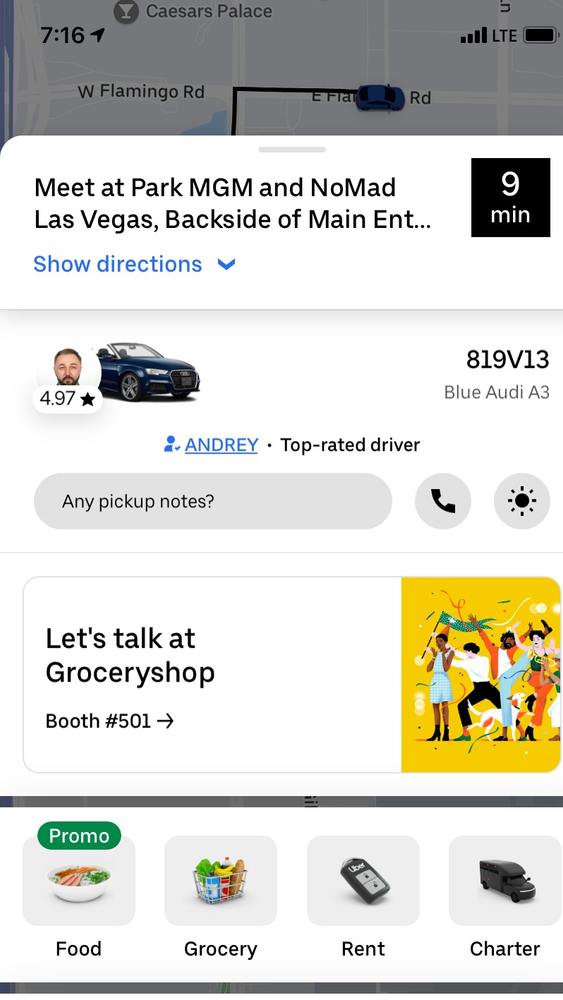

Uber leveraged Advertising Week to unveil Journey Ads, a new venture that will let advertisers engage with its customers “throughout the entire ride process,” the company said. Led by former Amazon Advertising executive Mark Grether, the platform will Uber’s first-party data across its mobility and delivery businesses to provide “compelling new surfaces and closed-loop attribution to reach Uber’s audience of 122 million monthly active users.”

Advertising opportunities through Uber’s ride-sharing activity expand the ad offerings already available through its Uber Eats program. “We have a global audience of valuable, purchase-minded consumers who, as part of our core business, tell us where they want to go and what they want to get,” said Grether.

Shipt announced an integration deal that will let third-party operator CitrusAd run natively served in-grid display ads and sponsored-product advertising within the Target-owned delivery service’s ecosystem. “We know many of our partner brands already leverage CitrusAd’s technology, and we’re thrilled this integration will make it easy for them to optimize campaigns,” said David Young, Shipt’s VP of Consumer Packaged Goods.

In early 2023, 7-Eleven plans to enter the ever-growing retail media marketplace by launching Gulp Media Network, an initiative that will focus more on the insights-driving research opportunities behind the advertising platform than the media opportunities available through it. For more information, read our recent Retail Intelligence Report.

BevAlc specialist Drizly became the latest third-party delivery service to launch a retail media network. Drizly Ads will offer on-site search and display advertising (including homepage takeovers and inbox notifications), along with such offsite opportunities as email and social placement. Drizly was acquired last spring by Uber, which extended its own Uber Advertising into Australia in August.

At its annual “Search On” event, Google announced 9 new features that are designed to help provide a more immersive shopping experience as the world’s leading search engine seeks to rival the world’s largest product search engine, Amazon. The updates are largely aimed at providing consumers with more visual and experiential modes of shopping

Ahold Delhaize USA’s Peapod Digital Labs has revealed plans to create an end-to-end in-house retail media business that will greatly expand the capabilities of the AD Retail Media platform. Along with building up the internal team, Peapod will bolster its effort through strategic partnerships with Publicis Groupe’s CitrusAd, Epsilon, and Publicis Sapient operations. (Salt Lake City-based Quotient will continue as AD Retail Media’s digital coupon provider.)

The extensive planned enhancements to AD Retail Media’s capabilities include:

- the launch of a unified on- and off-site platform to deliver a single

- point of activation and measurement.

- the ability to leverage proprietary data to create more targeted ads

- and improve return on ad spend.

- the introduction of a single dashboard for transparently measured

- campaign results for both onsite and offsite transactions.

- additional self-serve control of program management.

____________

The Mars Agency is an award-winning, independently owned, global commerce marketing practice. With talent around the world, they connect people, technology and intelligence to create demand and drive profitable, sustainable growth. Their latest MarTech platform, Marilyn®, enables marketers to make better decisions, create connected experiences and drive stronger results. Learn more at meetmarilyn.ai.