Technology trends in the commerce marketing space may shift from year to year, but one thing never changes: the need for brands and retailers to find more effective ways to influence shoppers.

Another thing that never changes is the importance of the brick-and-mortar store to brand success, regardless of however many other new modes of technology-enabled commerce might come along.

Those concepts were fairly evident last month at Shoptalk 2023 in Las Vegas, where marketing professionals and their cross-functional counterparts from brand and retailer organizations talked far less about the metaverse and far more about generative AI than they did at last year’s event.

But while the “tech du jour” may have changed, the objectives driving adoption of generative AI, the metaverse or any of the other technologies showcased and discussed at the event did not: strengthening shopper engagement, building brand loyalty and/or driving sales growth.

Throw in the many conversations about physical store growth and it seemed to some attendees as if the industry was reverting to old habits rather than moving forward: Forbes even summarized the event as a glimpse in retail’s rearview mirror as many companies “return to pre-pandemic trends and principles.”

That’s not entirely fair, because Shoptalk once again featured 700-odd vendors showcasing viable business solutions and more than 250 speakers talking about how to implement them. So it might just be that practitioners are becoming a little smarter about how, when and — most importantly, why — they should be leveraging the hottest new technology.

“We are in the golden age of commerce,” proclaimed Diana Haussling, VP-GM of Consumer Experience & Growth at Colgate-Palmolive (below), as she praised the potential for generative AI to drive innovation while warning adopters to avoid “tech for tech’s sake” and “keep the consumer at the heart of everything you do.”

According to Simeon Siegel, managing director at BMO Capital Markets, the key question to ask about any technology is, “Will it allow for anything that’s disruptively better than what’s already possible for the consumer?”

Put differently, as a question that brands and retailers have been asking for much longer, that query becomes, “Will it enhance the consumer or shopper experience in a relevant way?”

The following report offers a brief recap of the hot topics — technologies or not — that were seen and heard at this year’s Shoptalk by The Mars Agency’s contingent of attendees.

1. GENERATIVE AI

No one expected generative AI to be the marketing trend of the year when 2023 began, but just a few months later brands are investing more in this space than any other because of its innovation-driving potential, noted Colgate-Palmolive’s Haussling noted.

Haussling even predicted that generative AI will be the future of how brands connect with consumers by facilitating better experiences. “It’s not about if, it’s about how quickly,” she said.

“We are creating better content, better creative that is relevant to consumers,” said Haussling. “We’re also leveraging [AI] to understand trends, so we can adjust and react quickly — and then we’re leveraging it to inform our innovation.” Assigning all these tasks to artificial intelligence lets C-P’s “human capital” spend more time on strategic initiatives, she added.

About 25% of U.S. consumers interacted with AI as part of their shopping experience last holiday season, according to Assaf Baciu, Co-Founder & Chief Operating Officer of “motivation AI” platform Persado. And retailers using AI tools enjoyed a substantial increase in conversion, he claimed. “If you thought you had a good strategy — now there’s AI,” he said.

Not that there still aren’t kinks to work out of the technology. Legendary entertainment mogul Jeffrey Katzenberg (at left) was on hand to endorse “sanctioned AI,” in which an AI tool’s learning is restricted to content that has been pre-approved by the company it serves. (Katzenberg is an investor in Netomi, a customer service platform that providers that type of solution.)

That would help companies avoid generating content that doesn’t align with their brand, and perhaps also eliminate some of the factual errors that have been an early knock against generative AI in general.

In the future, AI will even allow brands and retailers to bring personalization to physical stores “in a big way,” Baciu promised.

2. DATA

One of the key benefits of AI is the ability to better gather and process the data needed to create the “access and intimacy” of personalized communication, according to Puneet Mehta, Netomi’s Founder and CEO.

While personalization is a marketing goal that’s long been waiting for the ideal solution, AI finally delivers on the promise because it synthesizes “a corpus of info we historically didn’t know and [therefore] couldn’t make part of the journey,” said Baciu.

Apparel retailer True Religion uses its shopper data to continuously refine a loyalty program that will foster lifelong customers, according to SVP, eCommerce Scott McCabe, who has been using customer input to design better shopping experiences on the retailer’s website and app.

“Our customers want to be engaged,” said McCabe, which is why True Religion is using the data it collects to find additional avenues for relationship building beyond the products it sells, giving loyal customers opportunities to help support their local communities and even experimenting in home base Los Angeles with social events that don’t focus on the brand.

3. METAVERSE

Discussions about the metaverse were far more subdued than they were a year ago, with some attendees pointing to the lack of compelling case studies around the technology and, admittedly, the slower than desired adoption levels among consumers. (Walt Disney Co.’s decision to shut down its fledgling metaverse unit, coincidentally announced as Shoptalk took place, didn’t help.) Haussling noted that C-P is “not leveraging the metaverse day to day, but we have to know how to play in this space.”

And then there’s Wendy’s. The QSR became one of the first metaverse marketing sensations in spring 2023 when it launched the Wendyverse. And the company continues to tout the technology’s engagement-driving and community-building benefits.

Wendy’s success is probably an early lesson in the need to make sure a technology trend fits strategically for the brand. As a challenger brand (to McDonald’s and Burger King), the QSR strives to be relevant and top of mind, especially with younger audiences.

“We want to be disruptive and find those connections with consumers,” said Jimmy Bennett, VP of Marketing for Media, Social & Partnerships. Consumers now look for the brand to take unexpected approaches to marketing, so the emerging metaverse seemed like a natural opportunity. “We wanted our fans to say, “I can’t believe Wendy’s did this,” Bennett said.

The Wendyverse features various game areas built around the QSR’s most popular products that are often additionally themed to cultural events like March Madness basketball or college football. The experience has become the most visited site on Meta’s Horizon Worlds platform, with user engagement averaging 12 minutes per visit.

Wendy’s treats the platform as a test & learn exercise, dropping concepts that don’t work and trying out new ones to keep the environment fresh. It repurposes content on other social media platforms to drive participation. And while you can’t actually eat in a metaverse restaurant (although you can earn coupons redeemable in the real world), the Wendyverse has given the chain a unique forum to connect with customers — and even let namesake “Wendy” participate as herself.

4. THE PHYSICAL STORE

While the industry might still be on the fence about virtual worlds, no one is denying the ongoing need for physical stores as a vital — and yes, still dominant — component of the retail ecosystem.

“No question [that] brick and mortar is here to stay,” asserted Chip Bergh, CEO of Levi Strauss & Co., which continues to open 100 stores around the world each year as part of an omnichannel direct-to-consumer strategy that lets the iconic brand “be in control of the experience” with shoppers (which includes gathering its own data stream, by the way).

Target considers store openings and remodels an important part of its long-term tech investment strategy, especially since these locations will be vital not only for the shopping experience but for the retailer’s fulfillment success, according to CFO Michael Fiddelke.

The “heart” of Ulta Beauty is its still-growing store base of 1,350-plus stand-alone locations and 350 units inside Target stores, said David Kimbell, the beauty chain’s CEO. The retailer works hard to create an inviting, exciting and inspiring experience that lets shoppers touch, smell and try products with assistance from knowledgeable store associates. Ulta is, of course, also investing heavily in digital capabilities that complement and supplement the in-store activity to ensure a seamless, intuitive commerce experience.

Done correctly, the physical store is “what retail is all about” because it provides the forum to deliver a “great customer experience” for shoppers who want to try on products, said Mary Dillon, CEO of Foot Locker. The athletic apparel retailer is rethinking its store strategy, however, closing some stores but opening others as it optimizes the footprint across banners, and moving away from malls to get “more convenient and become ingrained more in the community,” she said. The goal is to determine “where we’ll make the biggest difference.”

6. OMNICHANNEL

It should be obvious, then, that no matter how seamless technology can make digital shopping, the far more important goal is to build omnichannel solutions that give shoppers all the options they want.

“The one thing [great retailers] all have in common is great technology,” said Seemantini Godbole, Chief Digital & Information Officer at Lowe’s. But it’s the ways in which technology eliminates friction from the retailer-shopper communication and improves the shopping experience that matters, not the technology itself.

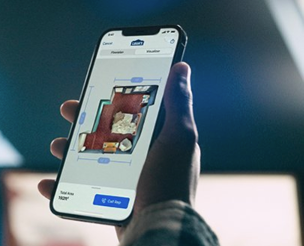

Younger, digitally native generations are so comfortable with their smartphones that Lowe’s decided a “spatial commerce” app would be a natural way to help them plan home improvement projects. The user-friendly app even borrows elements from games like Pokemon Go to make the process of taking spatial measurements more entertaining.

Omnichannel options are still critical, however, especially for the chain’s top 20% of customers, said Godbole. Redoing a kitchen, for instance, is a project that can take months to plan, and homeowners often want to investigate multiple possibilities to see how they might look. That leads them to browse on their iPads one day, but later in the journey feel the need to visit a store and consult with an expert.

7. DIRECT TO CONSUMER

Brands should be looking at direct to consumer initiatives as a strategy rather than a business model, according to Siegel at BMO Capital Markets. Even the most successful digitally native brands such as Warby Parker and Allbirds have ultimately needed to take an omnichannel approach to achieve scale.

On the other end of the spectrum, DTC can enable more traditional brands to take greater control of every aspect of shopper engagement, as Levi’s is doing.

Having achieved unrivaled success in the business-to-business side of the beer industry, AB InBev is now looking to be a leader in the DTC space as well, said Lucas Herscovici, the company’s Chief Direct-to-Consumer Officer. By going direct, AB InBev can deliver even greater accessibility and convenience to consumers — helping to create the “future with more cheers” that is the company’s purpose.

Among the early offerings: TaDa is a direct delivery service operating in 17 Central and South American markets that sells AB brands but also other spirits and snacks; PerfectDraft is an in-home keg system (like an espresso machine for beer) that already accounts for 10% of AB’s revenue in the UK, Herscovici said.

8. RECOMMERCE

The “circular economy,” where consumers are thrifting, buying second- hand items and even making their own products, is “where the puck is heading,” Bergh at Levi’s said.

It’s the next logical step for consumers who increasingly are looking for value, said Anthony Marino, President of second-hand apparel retailer ThredUP, which now powers the resale platform of more than 40 national brands. “If I can [still] get the great brands I love, why wouldn’t I do that?”

The concern for brands, of course, is that getting involved in recommerce might cannibalize the sale of new products, Marino acknowledged. The dangerous alternative, however, is to lose touch with consumers who are moving in this direction with or without your assistance. “If you can offer other alternatives” for shoppers to buy and experience your brand, “it’s a win-win. And you might have a customer forever,” he suggested.

About The Mars Agency

The Mars Agency is an award-winning, independently owned, global commerce marketing practice. With talent around the world, they connect people, technology and intelligence to make clients’ business better today than it was yesterday. Mars’ industry-leading MarTech platform, Marilyn®, helps marketers understand the total business impact of their commerce marketing, enabling them to make better decisions, create connected experiences and drive stronger results. Learn more at www.themarsagency.com and meetmarilyn.ai.