A special report on the most talked about topics at Path to Purchase Institute’s P2Pi Live event in October

INTRODUCTION

A lot has changed in two years since P2Pi Live was live and in-person. But a lot also hasn’t. A crew of Martians attended and spoke at Path to Purchase’s tentpole event in Chicago this October. Here’s what stood out.

Key concerns vocalized included Inflation, supply chain constraints, consumer media consumption shifts and the lack of industry standards — in measurement and also in retail media networks. In addition, measurement & data are two topics that marketers are most interested in, but can’t quite seem to crack the code on just yet.

What’s exciting is that the industry is robust with opportunities. Gen Z is a complex cohort, but a growing shopper of c-stores and drug as well as a developing audience for BevAlc. There is more data — and more granular data — than ever before at our disposal. This could give us a better understanding of customer behaviors and help us see what’s working in our marketing and what’s not. And in case you haven’t been paying attention, retail media is opening these doors of opportunity.

____________

When it comes to inflation and supply chain challenges, we’ve been here before. The difference is now we have better tools and better insights.

One strategy that can help brands build sales in recessionary times is rewarding the customers you already do have. Shopper loyalty programs aren’t anything new, but we need to be smarter about how we implement them. When you recognize shoppers for their loyalty like a small business does, you make them feel appreciated, valued and seen. Kroger said it’s important for larger retailers to take note and execute that at scale.

Secondly, “the customer is king” still rings true. Improving the customer experience requires a true understanding of what your customers value and then a plan to deliver a great—not good—experience. Brendan Witcher of Forrester Research believes there is a big gap in the personalization of marketing. Putting the customer’s name on the home page or sending a birthday message isn’t personalization, he cautions. Marketers should create a relevant experience with their brand instead. To do so, first understand what your customers value, and then reinforce it. If 80% of customers are willing to share information for a more personalized experience, you’d better make sure that experience is superior.

80% of customers are willing to share information for a more personalized experience

Andrea McGovern Galo, Tyson Foods, spoke to the human-centric approach of how to make their brands relevant to shoppers by building experiences around the person, not the brand or the retailer’s priorities. She stressed that “value” is not the cheapest price or biggest discount you can find. Brands who look beyond pure discounting can find value in building experiences with people, even during this inflationary environment where shoppers are price conscious.

It’s no surprise that Amazon is leading the way with customer-centric innovation and close behind is Walmart. Justin Honaman heads up the worldwide Consumer Packaged Goods (CPG) and Retail Go-to-Market team at Amazon Web Services where they are known for speed and scale and “customer obsession.” He says the new CRM is redefining personalization with digital commerce trends such as immersive retail, live streaming, and headless commerce, an architecture that allows brands to enrich the customer experience to address emerging touchpoints in quick, nimble ways.

Primal Kitchen has found ways to deliver relevant, engaging content without discounting price. The brand’s Senior Omnichannel Marketing Manager Kelly Meredith gave examples of their robust content marketing strategy, including exclusive recipes, that brought relevance to their products and inspired shoppers to want their quality products. She advises building brand equity by bringing the brand attributes to life with different tactics, both in the store and outside of the store.

Greg Arseneau, Shopper Marketing Manager at Barilla, said that in order to win brands should know their story and create ownable moments. He was also a big believer in rewarding loyal customers to establish a strong value exchange in order to gather zero party data.

____________

One way to do that is to use data science to understand the customer. If you can understand and then resolve their pain points, you can deliver a simple, empowering experience.

Data and insights demand is increasing. Companies want to make data science a competitive advantage. While this can help marketers simplify decisions and get ahead of the future with confidence, 84.51 cautioned that only a few are innovating to stay ahead. Marketers should look to the change-makers that facilitate data expansion, operationalization, acceleration, and collaboration with dedicated staff, focus and investments.

Kroger believes they have a headstart on this, developing methods that use customer attribute scores to personalize shoppers’ experiences. Ben Tienor, Director Brand & Customer Insights at 7-Eleven shared how they created a completely unique way to engage this audience, through their proprietary research initiative called The Brainfreeze Collective. This is essentially a new research capability that allows them to recruit and ask questions to any generation of shoppers and get their input in real time – whether that’s on new products, campaign ideas, promotional offers or anything.

“So, this allows us to better understand not only what shoppers like or don’t like about a product or experience,” Tienor explained. “We can connect what they say with what they actually do and buy — giving us the why behind the buy….at scale.” Their ability to connect and learn from Gen Z shoppers in real time is something that should also be paid attention to by other networks.

____________

There were many references to a “collapsed funnel.” Everyone seemed to agree that marketers must balance the full funnel, not just the partial funnel.

Ecommerce was the number one growth driver before COVID and it still is today. And “to win in store, you must win online first,” says Chris Perry, co-founder of firstmovr and educator on all things Ecommerce. Digital and Ecommerce influence 90% of sales, but the majority of sales are still in store. The four Ps (product, price, place, and promotion) have not changed. However, it’s how they have come together that has changed. And for that to happen it’s going to require mastering many new capabilities. Now, Ecommerce is more complex and encompasses multi-dimensional shopper, shelf, assortment and content with many interdependent touchpoints, tools and technologies.

Ecommerce is the No. 1 growth driver

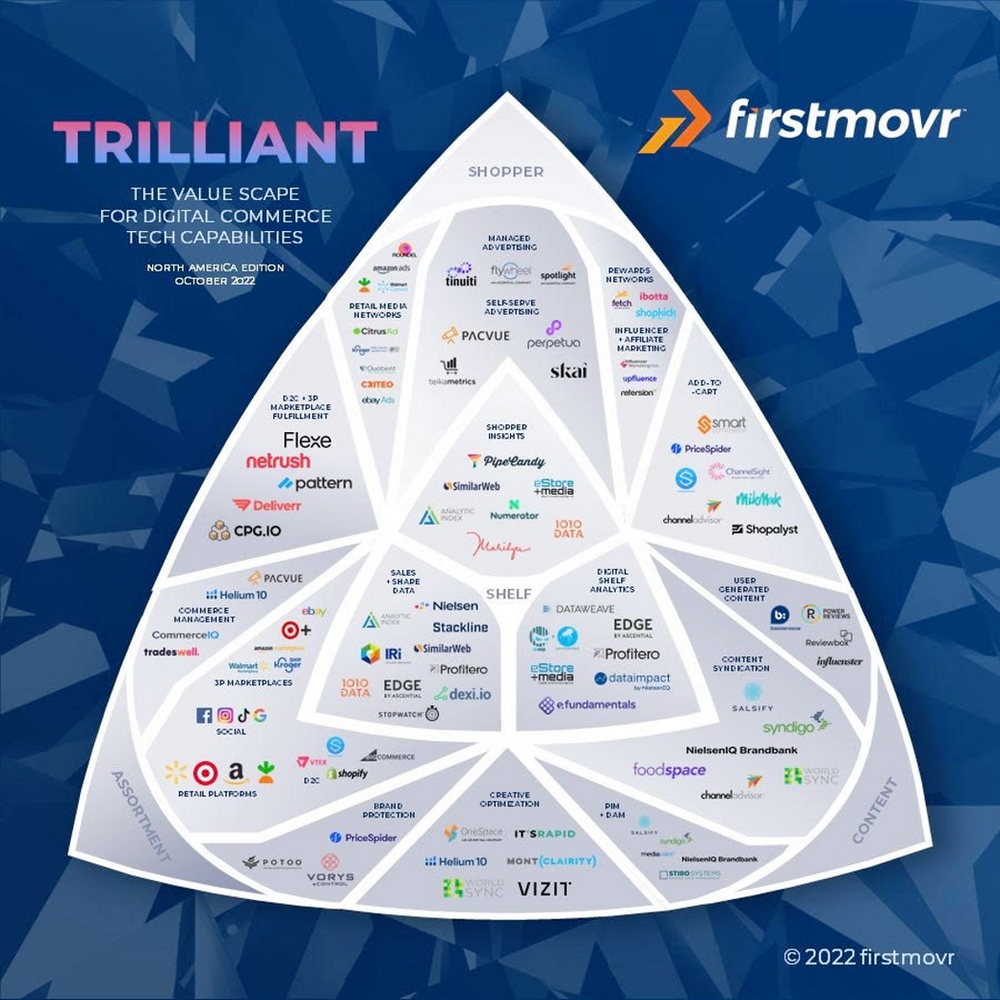

Perry presented an approach to help marketers decipher the array of tech tools available that are helping marketers win online. He shared a new model he has labeled the Trilliant.

It breaks down these platforms into 13 easy-to-understand capability categories: managed advertising, shopper insights, direct to consumer & third-party fulfillment, commerce management, third-party marketplaces, brand protection, creative optimization, sales & share data, digital shelf analytics, content syndication, PIM (product information management) + DAM (digital asset management), add to cart, and user generated content. Perry claimed his lists might not be inclusive of every tool available right now as this space is quickly growing and evolving, but he’s done his best to include the top resources available.

Yet, Derek Correria, President of ReserveBar, cautions that, “Ecommerce is not just a channel.” Like adult beverages, it is flavorful, diverse and sustainable. Brands need to “thread the needle” from the moment that they could create a sale to as quickly as possible the ability to purchase and complete that sale. Are you capitalizing on impulse as much as you could? Are you making all of your content shoppable? He recommends thinking about how Ecommerce can improve the whole business, not just as a channel. Using technology to improve the business is where brands and retailers should be focusing their efforts.

There has always been friction in the marketplace and, with more ways to shop than ever before, there are even more points of friction, but also more opportunities to remove that friction. Bryan Gildenberg, SVP Commerce at Omnicom Commerce Group stated, “U.S. grocery shoppers are the world’s switchiest.” This is a moment to take advantage of the fact that everyone’s habits are disrupted. It’s up to you as a brand to take steps to move them in the right direction. By changing shopper behavior, you can move your business forward.

Gildenberg suggests marketers need to find the wow, right now in their proposition and replace content, media and commerce. Instead think engagement, precision and immediacy because soon those three separate aspects will converge. Digital media now needs to be more closely linked to the total retailer joint business plan on the supplier side. We need to break down the silos between structures, budgets, skills and even KPIs. The problem he sees is that people who know retail really well don’t understand retail media, and those in retail media don’t really know retail. The KPI alignment is less important than the perspective alignment.

46% of consumers will look for alternatives if it becomes cost-prohibitive

Yet there is an opportunity for brands. He gave a “wet cement analogy.” Most of our routines are changing, namely how we spend our money and how we spend big segments of our time. “This may be the best opportunity you ever have to change consumer/ shopper/ retailer behavior,” he stated. New partners, as Chris Perry also noted, could help do that.

____________

Marketers are also still trying to find big “Aha!”s within Gen Z, a generation very much shaped by the economic and social activities that they’ve been through. They want to be different than other generations and expect weird, wacky and wild. They also expect things to be less homogenous and more customized and are willing to pay more for it.

1 in 3 discovered a product on TikTok and bought it on Amazon

The most visible way that 7-Eleven attracts this audience is by leaning into the strong fandoms that exist within their brand fan community—from gaming to fashion to sports. The retailer is leveraging their first party data to better understand what their younger shoppers like and what they positively respond to so they can effectively connect with those consumers and build credibility, relevance.

Another area of opportunity is social commerce. Marketplaces are still a big source of discovery, but younger consumers are discovering more on social media. Hamutal Schieber, founder of Schieber Research stated social commerce is growing three times faster than total Ecommerce. She shared three drivers:

- Sustainability & Affordability. They know that the world and economy is very unstable and they see thrifting, upcycling, reselling as an answer.

- Identity & Creativity. Their visual identity is just as important as their physical identity, if not more so.

- Stress & Trust. They are very much fueled by creator-led commerce and possible retailer collaboration.

Schieber believes that, “there is money on the floor in other platforms, too,” citing that this generation and younger are already socializing and shopping in gaming.

____________

Finally, people are still craving moments of joy. However, all of those things that were once the source of joy during the pandemic such as furniture, home improvements, technology, in-home entertainment, have now shifted back to areas such as travel. Impulse purchases and immediate gratification are here to stay. “It’s up to brands to make sure that their products are meeting customer needs right now and also into the future,” says Elizabeth Lafountaine, Chief Retail Analyst at Retail Leader Pro.

Some additional interesting ideas were mentioned off the stage. Could 2023 bring a rise in Me Commerce and Black Box stores?

Download a PDF version of this special report.

The Mars Agency is tracking all these trends and challenges to better inform and guide strategies for the brands and retailers we work with. To learn how we can help your organization, email us at [email protected]. To stay on top of insights like this, subscribe to our newsletter.