The following article presents agenda highlights from P2PI Live, the Path to Purchase Institute’s annual conference and expo for commerce marketing professionals. This year’s event was held in St. Louis from Nov. 7-9.

Return on Relationship: The New ROAS

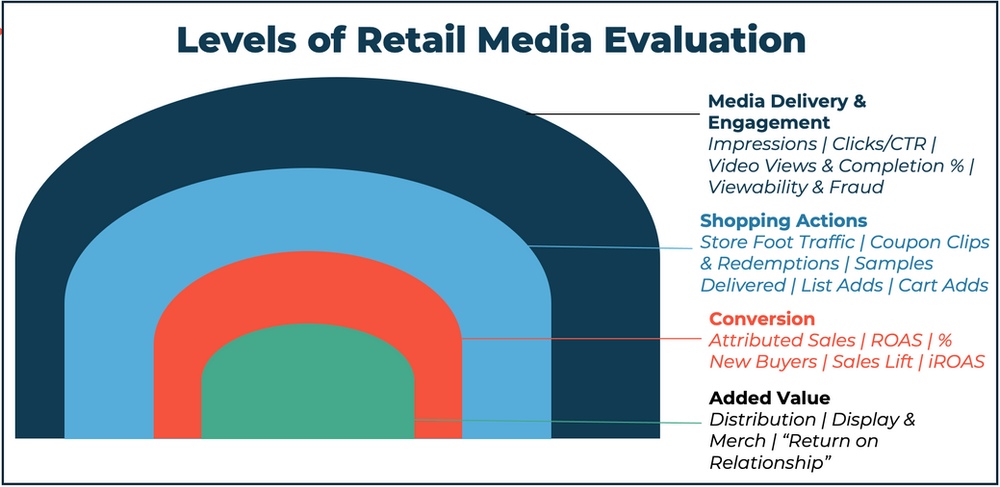

Conversations around improving and standardizing retail media measurement typically focus on hard numbers and percentages, the need for brand advertisers to clearly understand the impact of their investments through metrics that pinpoint incremental sales and new-to-brand buyers, among other performance-based KPIs.

Conversations around improving and standardizing retail media measurement typically focus on hard numbers and percentages, the need for brand advertisers to clearly understand the impact of their investments through metrics that pinpoint incremental sales and new-to-brand buyers, among other performance-based KPIs.

But these conversations often forget one ongoing truth about the retailer-vendor dynamic: “This is still a relationship business,” said Kelly Kachnowski, VP-Growth & Engagement for Data & Analytics Technology at The Mars Agency, while moderating a panel discussion on that very topic at P2PI Live in St. Louis earlier this month.

To address this truth, brand advertisers need to adopt a holistic approach to measurement that looks beyond typical media metrics and even tangible campaign performance KPIs to consider the “return on relationship,” a more intangible assessment that seeks to qualify (if not quantify) the broader impact that retail media investments have on the brand’s overall partnership with that retailer.

The goal is to understand the “value add” that retail media spending can deliver through the additional marketing and merchandising support it can often unlock, according to Jeffrey Bustos, VP-Measurement Addressability Data at the IAB.

To learn more about optimizing measurement, read “Making Sense of Retail Media.”

To accomplish that, brand organizations need to develop a “democratized view” toward buying retail media that will bring together internal functions and facilitate consistency in success measurement, said Bustos. Fully optimizing retail media requires an understanding of what’s happening elsewhere at the retailer, such as trade deals and in-store activity, he said.

While undertaking structural change to eliminate functional silos is one option for driving change, Bustos noted that recent research from Profitero found that 60% of organizations that have restructured were dissatisfied with the results.

But the necessary behavioral changes can take place with restructuring, Bustos suggested. “Silos will continue to exist, but brands must align internally on KPIs so they can have holistic negotiations with retailers.”

Retail media networks are starting to see brand partners modify how they measure success. They’re finding ways to evaluate the full-funnel impact on business objectives rather than simply checking ROAS/iROAS, and looking beyond campaign performance to measure long-term growth, said Vin Lay, Director of Audience Science & Measurement Strategy at Albertsons Media Collective.

Embracing these strategies demands greater collaboration to ensure omnichannel planning and activation, not only internally but with the retail media networks themselves, said Lay. Partnership-minded networks are working with brands to help determine the best KPIs for measuring success, she said.

Trust and consistent communication are required elements for success, along with a willingness to change and continuously experiment, said Lay, who also recommended organizational education and training “so your teams are equipped for collaboration.”

How the ‘New’ Four Ps Drive Omnichannel Growth

The classic “4 Ps” of marketing — Price, Product, Place and Promotion — are “the things we still to think about,” according to Cheryl Pinkham, Director of Shopper Marketing for Ahold Delhaize’s Peapod Digital Labs. But they have evolved in ways that are having a significant impact on effective shopper engagement.

1. Price is no longer just the literal cost of a product but “a perception in the mind of the customer” that’s influenced by the entire shopping experience. So while 70% of shoppers say they’re concerned about rising food and gas prices, they’re also looking for help reducing stress, maximizing their time, maintaining job security, and occasionally treating themselves as they watch their spending overall.

In response, retailers and brands need to formalize their objectives based on the specific shopper behaviors they want to influence (Food Lion’s “Easy, Fresh & Affordable” positioning is a great example); focus directly on shopper needs rather than internal goals; keep the message simple and consistent; and sustain the effort (because influencing shopper behavior takes time).

2. Purchase behavior has become extremely complicated, requiring retailers to “understand, anticipate and encourage” an array of shopping options. While nothing about Maslow’s classic Hierarchy of Needs has fundamentally changed, “What has kind of messed it up is social media,” laughed Pinkham, further explaining that the manifestation of these classic human needs has changed substantially.

With technology enabling consumers to be “connected” across numerous touch points, marketers must take a “commerce everywhere” approach, being in the right locations at the right moments (to stay consistently top of mind); offering a compelling proposition; providing a quick, easy path from trigger to purchase; and keeping technology strategies grounded in trust and human connection (although AI will play an important role).

3. Personalization now supersedes standard promotion and is the key to long-term loyalty. There is still a place for “commercial loyalty” driven by mass offers, but 71% of customers expect personalization, 80% prefer brands that deliver personalized experiences, and 90% are drawn to advertising that resonates with them. What’s more, Deloitte finds that well-executed hyper-personalization can increase sales 10%.

While the upside is high, marketers must ensure that their efforts will feel natural not just to shoppers but for the brand; that the message (and offer) is as simple as possible; and that the personalization is legitimately needed to positively impact the purchase journey. (Sometimes, that mass offer is sufficient.)

4. Place now encompasses “everywhere and everyone.” Omnichannel is no longer an option but a necessity because 30% of consumers view it as “just shopping,” Pinkham said. Brick-and-mortar is still the most important sales channel (55% still shop there exclusively, and 92% to some degree), but the majority of purchase decisions are happening in the digital environment.

Marketers might be overcomplicating matters by thinking about “omnichannel” rather than simply embracing this new shopping reality. “Place” no longer has any physical boundaries and requires staying top of mind while delivering a seamless experience that respects how, when, and where customers want to be engaged.

5. People represent a new fifth “P” and are needed to establish the connections across commercial, retail media, shopper, and loyalty strategies required by retailers to develop “a clearly defined strategy for total commerce,” said Pinkham. “We really need to have that collective power.”

Product Innovation: Ask the Right Audience or Get the Wrong Answer

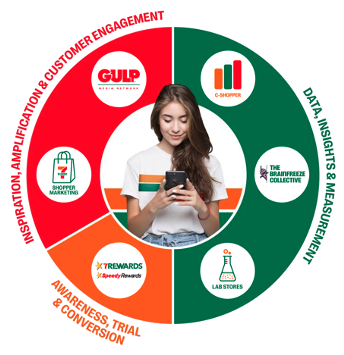

The quality of consumer research depends largely on asking the right question to the appropriate audience, according to Ben Tienor, Director of The Brainfreeze Collective and Gulp Media Network at 7-Eleven.

Yet much of the consumer research guiding innovation at retail comes from limited, disjointed data sources that too often rely on claimed, rather than actual, behavior. That results in a high failure rate for new product introductions.

7-Eleven has been working to eliminate these limitations through a multi-tool “Immediate Consumption Ecosystem” that uses actual transaction data from the retailer’s C-Shopper library, custom panel data gained directly from its Brainfreeze Collective of 200,000 loyal shoppers, and behavioral data collected in soon-to-open Lab Stores that will serve as testing grounds for innovation.

To illustrate the concept, Tienor outlined a hypothetical case in which a salty snacks brand identifies lost category buyers through C-Shopper data; learns the reasons behind the leakage and collects feedback on potential innovation solutions through the Brainfreeze Collective; then taps the Lab Stores to test, refine and prove the concepts in a small-scale, real-world environment before risking a more extensive rollout.

The rest of 7-Eleven’s Immediate Consumption Ecosystem is then available to drive awareness, trial and conversion through the 7Rewards loyalty program, shopper marketing activation, and Gulp retail media campaigns. But Tienor noted that these kinds of learnings will be applicable to the entire c-store channel.

Tienor and co-presenter Francisco Siles, Senior Manager of Brand and Customer Insights, shared several examples of the stark difference between the data collected through the Brainfreeze Collective and standard panels. In one, traditional and matched panels overstated purchase intent for a particular product by 30%. In another, 28% more traditional/matched panel respondents claimed to buy the product than actually did so.

Innovating with Data Science

“Rarely do I see a CPG company over-invest” in their data science capabilities, said Brendan O’Brien, Director of Commercial Insights for Kroger’s 84.51° data division, before joining with Marianna Sugarman, Shopper & Digital Commerce Manager at Barilla, to outline a strategy for optimizing lean resources.

The first step is to align the business and technical teams, O’Brien advised. Establish shared objectives and focus on specific business-driving initiatives, making sure the technical team understands the context. From there, design a process for ongoing collaboration.

Even very lean teams can make a substantial impact if they are given access to the right data and tools and can leverage pre-built capabilities to accelerate value creation. It’s important to earn some “quick wins” to build momentum between the teams and gain recognition within the organization, he said.

CPGs working with 84.51° in 2023 focused largely on five data science packages: creating custom KPIs to input into their business intelligence tool, optimizing planograms and shelf assortments, adding demographics to their behavioral analyses to get more complete customer segments, building custom audiences for Kroger Precision Marketing (KPM) retail media campaigns, and evaluating pricing and promotion activity.

Identifying the right business initiatives to tackle involves answering three questions:

- Priority: Is the initiative clearly linked to company objectives?

- Actionability: Will the insights be able to drive a defined action? (“Know what you can do with the answer before you ask the question,” said O’Brien.)

- Feasibility: Do you have the right resources to accomplish the task?

Barilla was able to apply these principles to determine how best to respond to an organic spike in sales for a product that hadn’t received marketing support in years.

Aligning its London-based Barilla Acceleration central insights team with the shopper marketing team in the U.S., the pasta brand mined data in the 84.51° Collaborative Cloud for descriptive insights to identify the opportunity and predictive insights to pinpoint the right audience, Sugarman explained. The shopper marketing team then developed a cross-channel program that increased household penetration 1.8 times better than KPM benchmarks.

The effort also established an effective new way of working between Barilla Accelerate and the shopper marketing team, Sugarman said.

Omnichannel Reach and Real-time Engagement

Whether it’s called “omnichannel” or something else, consumers have built their own comfortable shopping ecosystems — which makes it critical for alcoholic beverage brands to follow suit internally by working cross-functionally.

Although ecommerce growth has “normalized” since the pandemic, all of the digital work conducted in recent years is having a significant impact on in-store purchase decisions, noted Tammy Ackerman, Vice President of Retail eCommerce at Treasury Wine Estates.

That recent growth has also given greater “share of mind” internally to ecommerce, which is now brought into planning discussions earlier and more frequently, said Mara Sherman, Director of Commerce at Starcom. And brand teams are far more aware now that they need to understand commerce media, she said.

“Our media agencies haven’t quite adapted” yet, said Ackerman. “A digital ad in Times Square gets attention that commerce media ads don’t,” even though “commerce keeps the lights on.” “Big brands still want to have that big splash, but they recognize the role that commerce media plays in driving the business,” added Sherman.

Retail Media Hot Takes

During a game show-style discussion on P2PI’s main stage, VLMY&R Commerce CEO Tyler Murray asked his panelists for their perspectives on the following topics:

1. Regardless of any other KPIs that might be used, incremental sales is still a critical metric for performance.

“The way we measure success is by looking at inventory,” said Yolanda Angulo, Director of Commerce Marketing at Mondelez International. “Our organization is going to ask us for that ROI, and we have to deliver.”

“I need something to share with my sales team [that they can then] share with their category managers,” agreed Julie Herceg, Director of Shopper Marketing for American Greetings.

“I need something to share with my sales team [that they can then] share with their category managers,” agreed Julie Herceg, Director of Shopper Marketing for American Greetings.

“But we have to align on the methodology and be completely transparent about the data,” said Angulo. “It’s really critical to make sure both sides are stepping up,” added Herceg.

2. Although paid search is the most-funded retail media tactic, “you need a multi-faceted approach that will reach the shopper across her journey,” said Herceg.

Determining which tactics to use depends on a variety of factors, including category, brand and objective, said Angulo.

3. Bringing retail media into the store will be a positive exercise “if it’s relevant and executed well. You can’t just throw signs everywhere,” said Herceg. “And like everything else, we need to test it.”

“It could get crazy,” warned Angulo. “How will the rates be decided? And how are we going to measure it?”

4. First-party data is a critical aspect of retail media, shopper marketing and even media advertising, but brands need to evaluate how much of an investment they should make beyond what their retailer partners provide free as part of standard business agreements.

“We need to understand shopper data, to see what else is in the basket — and frequency is important, too. We just need to be smart about how to use it,” said Herceg.

“You have to [accept the fact] that it’s going to require a long-term commitment and investment. But it’s really important,” said Angulo. “You have to be very strategic.”

5. Personalization “is the continual evolution of retail media. Why do we have first-party data in the first place” if it isn’t used all the way through to campaign creative, asked Angulo.

“It is everything,” concluded Herceg.