Retail Intelligence from:

As part of their ongoing mission to help clients stay ahead of the competition in a fast-paced, constantly evolving marketplace, The Mars Agency’s Customer Development teams closely monitor the strategic activity taking place across all key retailers and channels.

Each month, the teams compile Marketplace Assessment reports on the retailers (Walmart, Target, Kroger, Amazon) and channels (Regional Grocery, Small Format, Club, Emerging) that are most important to our clients’ business success. The following report outlines 7 noteworthy events across the retail landscape from the team’s most recent round of assessments in October.

____________

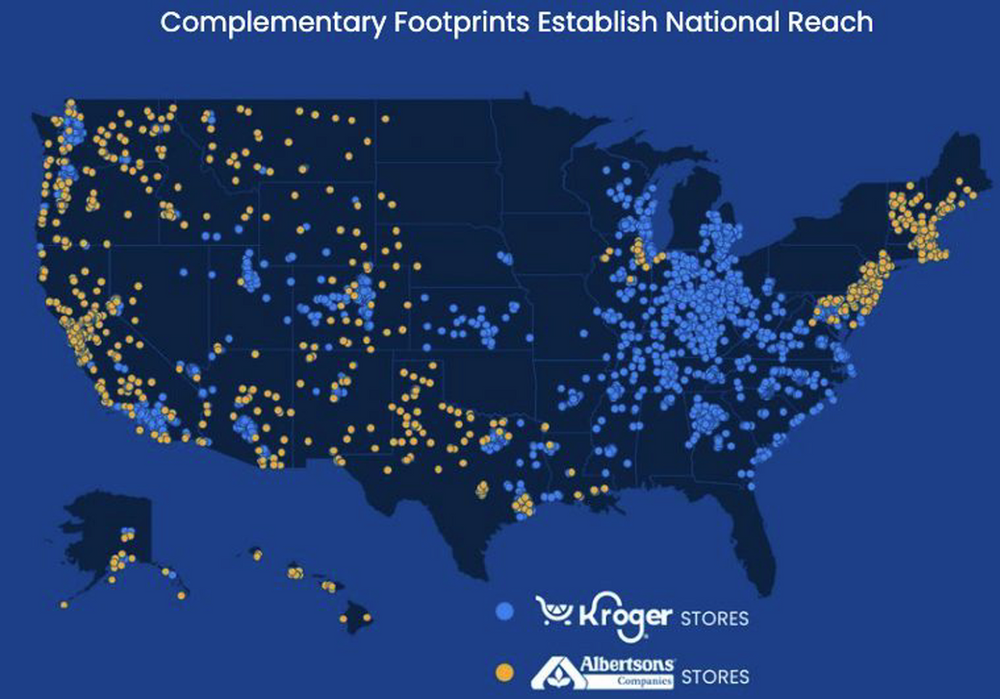

Kroger, Albertsons to Merge

The Story: You already know the story. The nation’s No. 1 and No. 2 supermarket operators will unite to create a retailer of epic proportions: $209 billion in sales, 5,000-odd stores, 85 million shopper households, 4,000 pharmacies, 2,000 fuel centers (assuming the FTC doesn’t require too much in the way of divesting).

Relevance: A combined Kroger-Albertsons doesn’t quite top Walmart in size, but it comes pretty close. And it does create another truly national grocery retailer. Kroger expects the merger to accelerate both its go-to market strategy — which had involved expanding its footprint via ecommerce initiatives — and its value creation model.

We agree. The merger should let the company literally “double down” on many of the initiatives the two grocers were pursuing individually: in the aisles, a focus on fresh food and winning with “Own Brands,” and for shopper engagement, greater personalization and “seamless” experiences (which is Kroger-speak for omnichannel shopping).

Opportunity: Kroger was already a top-tier account for most CPGs, but this merger makes it one of the most important relationships to nurture to drive future growth. It will be interesting to see how the massive scale will affect the retailer’s current strategy for vendor partnerships.

Source: Kroger

____________

Walmart Turns Creators into Sellers

The Story: A new platform called Walmart Creator is a one-stop portal designed to makes it easy for social influencers and other creators to monetize their activity by making shoppable content that showcases products from the retailer.

“Walmart Creator empowers you to share your passions & earn money while you do it,” promises the platform’s home page. “Whether you’re a first-time content creator or an established influencer, you’ll find all the tools you need to make, share, earn & live better.”

Relevance: Consumers are often inspired by the content and stories they find from their favorite influencers through their social feeds. Walmart is looking to take that inspiration one step further for its customers “by connecting their favorite creators directly with our brand and the brands they love at Walmart,” said William White, Chief Marketing Officer for Walmart U.S.

For influencers and creators, Walmart Creator offers a new opportunity to monetize their content and earn commissions on any sales they generate. The tool will also help them “better understand your audience analytics, develop your aesthetic, and scale your brand,” the portal promises.

Walmart has been an early pioneer in the social commerce space and is constantly testing and learning in new channels such as shoppable livestreams. The goal is to better serve its shoppers by meeting them when, where and how they want to shop. Walmart Creator represents another expansion into this space, further enabling shoppers by shortening the distance between inspiration and purchase.

Opportunity: Although Walmart didn’t immediately announce any advertising opportunities as part of the initiative, suppliers should closely monitor how the platform evolves — and performs — to see what brand integrations might become available later.

Source: Walmart

____________

Closed for Thanksgiving

The Story: Walmart, Target, Best Buy, and other large chains will again close their stores on Thanksgiving Day, continuing a practice that many chains first started in 2020 in response to the pandemic.

Relevance: With the growth of online shopping, retailers aren’t as reliant on specific days to drive sales anymore. They originally started opening their doors on Thanksgiving to get a competitive jump on the Black Friday sales frenzy, but the practice has always been a source of tension for employees (not to mention labor advocates), and an annoyance for many shoppers who would have rather stayed home to digest their dinner.

Now, online shopping has even reduced the importance of Black Friday as a sales driver; we’re seeing holiday deals start earlier and continue throughout the season, making it far less important to lure shoppers out on Thanksgiving Day — especially since they can shop from home if they want.

Opportunity: Door Busters are becoming ghosts of holiday past; online deals are the present and future of holiday shopping.

____________

Kroger Tests Smart Carts

The Story: Kroger recently began beta testing “KroGo” smart shopping carts in a store near Cincinnati headquarters. The retailer is calling the technology “game-changing for checkout.” (We tested out the cart. Here’s the review.)

Relevance: Understanding that the checkout line is a major pain point for shoppers, Kroger has investigated various technologies in recent years, typically using this kind of one-store test for a considerable length of time before rolling out anything to the rest of the enterprise.

KroGo could be the retailer’s most sophisticated concept yet, in terms of both capabilities and possibilities for improving shopper engagement. If they can prove viability and, more importantly, profitable, Kroger might scale this one very quickly.

Opportunity: “Seamless” isn’t only a digital term. Smart carts like KroGo have the potential not only to improve the in-store shopping trip but also to better align the omnichannel experience by uniting the digital and physical aisles right there in the cart. And they will give brands a chance to speak to shoppers right there at the first moment of truth, to remind them of deals they saw previously or give them new, relevant offers.

____________

Walgreens Showcases the ‘Future of Pharmacy’

The Story: Before the pandemic began, Walgreens undertook a technology transformation aimed at freeing up their pharmacists from routine tasks so they could devote more time to direct contact with customers. Today, the retailer operates eight micro-fulfillment centers, that are using robotic technology to fill routine prescriptions across 1,800 stores.

Each robot in an MFC can fill up to 300 prescriptions per hour, which is roughly the same amount that a pharmacist can handle per day in a typical Walgreens store. That’s letting pharmacists located near the MFCs come out from behind the counter, interact with customers in the store and even follow up with them by phone, making sure they’re taking their medications as directed and getting their refills on time.

Additionally, these pharmacists are meeting every other week with healthcare workers from VillageMD, which operates roughly 200 primary care clinics inside Walgreens stores, to discuss ways to better coordinate the care they provide to patients.

Relevance: The prescription efficiency delivered by these MFCs is just one aspect of Walgreens’ massive efforts to transition its business model from retail pharmacy to full-service healthcare. Walgreens owns a majority stake in VillageMD, and last month helped its partner acquire urgent care provider Summit Health-CityMD. “Consumer-centric healthcare solutions” are “our next growth engine,” Walgreens CEO Rosalind Brewer said during an October earnings call.

Opportunity: As Walgreens continues its transition, packaged goods brands should find ways to become part of the full-service conversation through partnerships that will help the retailer address customer needs. A good place to start might be to help pharmacists improve their customer interactions by providing key information directly or via educational materials at-shelf that can give shoppers quick solutions to their problems.

Source: Walgreens

____________

7-Eleven Wants a Gulp of Retail Media

The Story: In early 2023, 7-Eleven will enter the ever-growing retail media marketplace by launching Gulp Media Network, an initiative that will focus more on the insights-driving research opportunities behind the advertising platform than the media opportunities available through it.

Those research opportunities are:

- 1st party data on 80 million-plus 7Rewards loyalty cardholders.

- The Brainfreeze Collective, a 160,000-strong customer panel that can be used for custom surveys and focus groups.

- Lab Stores, a handful of brick-and-mortar stores that will use various tracking technology to record shopping behavior.

As for the media opportunities, Gulp will initially focus on offsite, traffic-driving tools rather than activity on 7-Eleven’s own website, according to Mario Mijares, 7-Eleven’s VP-Insights, Loyalty, Marketing & Monetization (at left), while speaking last month at Advertising Week in New York.

“We talked to a lot of our vendor partners, and they told us it’s a headache for them because retail media is very fragmented,” Mijares said. “We wanted to make sure we didn’t contribute to that problem. We wanted to come up with a solution for them.”

Relevance: 7-Eleven is the first convenience store operator to roll out a network, and its database of younger-skewing shoppers (Gen Z and young Millennials) and “immediate consumption” purchases are a significant point of differentiation in the existing retail media marketplace.

Opportunity: Gulp’s robust, unique research foundation could make partnerships beneficial long before any media is actually placed through the network. And 7-Eleven’s audience could be a natural fit for any brand targeting Gen Z and/or relying on impulse purchases to drive growth.

Source: 7-Eleven

____________

Meta Quest Pro Launches

The Story: A new tool for the metaverse is bringing major innovation and additional use cases to one of the hottest trends in technology.

Developed by Meta-owned Reality Labs, the Meta Quest Pro is a mixed reality headset that combines a physical environment with virtual elements to help users enhance their social presence and even improve their work-related productivity and collaboration. Instead of being confined to a desk, users can set up a large virtual workspace with multiple screens spread all around them while still using their physical keyboard and mouse.

Relevance: The metaverse isn’t just for gaming anymore. Most forecasters believe the metaverse will someday become as ubiquitous as laptops. But while most of the conversation involves gaming and other forms of social interaction, tools like the Meta Quest Pro suggest the metaverse could deliver the future of workplace activity as well.

Opportunity: At the initial price point of $1,499 per headset, it’s not likely that you’ll all be wearing a Meta Quest Pro on your next team call. But it might be a good idea to start exploring how technology like this can enhance the work environment and improve the collaborative process.

____________

The Mars Agency’s Customer Development practice is an unrivaled team of in-market commerce experts who simplify the complexity of retail. Located in Bentonville, Minneapolis, Cincinnati, Chicago, Tampa and the “backyards” of other key retailers, they provide deep knowledge of the retailer, expertise in key business areas (like strategy, media and creative), and door-opening personal relationships with key executives to deliver an unmatched level of business success for clients across accounts, channels and shopper engagement platforms. For more information, contact Group SVP Kandi Arrington at [email protected].