As ad opportunities enter the brick-and-mortar environment, marketers should focus on the shopper experience and find effective ways to measure both behavior and results.

Efforts now aggressively underway to expand the retail media marketplace into the physical store reflect an industry “going back to the basics of retail marketing,” but now with the technology-enabled ability “to make it more personalized and relevant for the shopper,” according to Kelly Kachnowski, VP-Growth & Engagement, Data & Analytics Technology, at The Mars Agency.

“We have an opportunity to bring the brand experience into the store and then close the sale, as well as to find ways of digitizing analog tactics like product displays and sampling to make them more efficient,” said Kachnowski, while speaking in New York last month at a special one-day event called, What’s In Store for Retail Media Networks.

“We can also add an in-market, real-time element that will let marketers react to the local environment,” she said. One example: customizing messaging to drive additional stock-up purchases when soon-to-be homebound families rush to the store to buy milk, eggs and bread as the weather forecast calls for major snowfall.

Produced by digital signage solutions provider Stratacache in conjunction with the National Retail Federation as part of the latter’s annual “Big Show,” the conference featured a number of speakers from the retail, brand, technology vendor, and academic communities discussing the opportunities and challenges facing the industry as retail media networks expand into the physical store.

The Media Challenge

Any retail media deployment “has to provide value,” which makes the simple installation of screens to count shopper impressions “such a bad way to start,” warned Evan Hovorka, VP-Product & Innovation at Albertsons Media Collective. “You need to remember the core reason for being there: removing friction for the shopper, driving sales for the brand.”

“The brands we work with at The Mars Agency are looking to enhance the shopper experience more efficiently. Traditional in-store activation has been expensive and labor intensive, so digitizing the activity can potentially bring down costs,” said Kachnowski. “Brands are also looking for more ways to tell their story — opportunities to engage the shopper through a unique experience.” The ability to optimize in-store creative is also a significant consideration, she said.

While digital screens are obvious technology option for bringing the omnichannel experience into the store, they can easily be distracting rather than informative and inspirational, said Hovorka. Placement, therefore, needs to be physically “in line” with the shopping trip and contextually relevant — like a screen for recipes above the avocados display, he suggested.

“We first need to look at how the media is going to enhance the shopper experience, and how that will impact the shopper’s experience with the brand,” said Kachnowski. “This isn’t just an opportunity for a sale, it’s an opportunity to build the brand relationship with the shopper.”

“There’s a whole wide world on your phone” that can also be unlocked to deliver in-store engagement via QR codes, beacons and other links, said Kachnowski. Given the costs associated with technology implementation, the smartphone represents a less-expensive and faster way of bringing in-store retail media to life.

Overall, there are four key roles retail media can play in the store, according to Jeffrey Bustos, VP-Measurement, Addressability & Data for the IAB (Interactive Advertising Bureau):

- As a strategic growth driver for retailers by enhancing customer reach and sales.

- To deliver omnichannel experiences by linking to the online stages of the shopper journey.

- To personalize customer interactions via shopper data-driven tailored experiences.

- To build brand loyalty and inspire repeat visits by engaging customers with relevant messaging.

Brands, meanwhile, can benefit through sales growth as well as more efficient, targeted marketing investments, according to IAB.

Those findings come from IAB’s new report, “Quantifying Retail Media In-Store Success: Measurement & Innovation,” which was released to coincide with the NRF event and produced with contributions from Kachnowski, Claire Wyatt of Albertsons Media Collective, The Mars Agency’s Julia Miller and Julie Argonis, and four dozen other representatives from across the retail media landscape.

Source: IAB

The Measurement Challenge

One of the most important considerations when finding relevant solutions for shoppers and advertisers is the need to implement scalable in-store media that will effectively capture data, both to inform effective advertising and to measure program effectiveness.

For the IAB, that consideration involves not only finding ways to quantify the media’s impact on in-store sales and shopper behavior, but ways of unifying in-store data with offline data to facilitate a cohesive omnichannel strategy — while also staying respecting consumer privacy.

Measuring in-store activation has been an historical challenge, typically addressed through the use of marketing mix models and other advanced data science methodologies, said Kachnowski. But setting up the right data-capture technology to get more accurate information can be tricky and expensive.

Compounding the problem at the moment is the plethora of vendors that retailers are using to quickly ramp up their media inventory. “Five different, disconnected solutions won’t work” to deliver the coherent understanding of the store that’s needed, said Hovorka. “But a centralized system spanning all solutions will require “a pretty significant technology investment.”

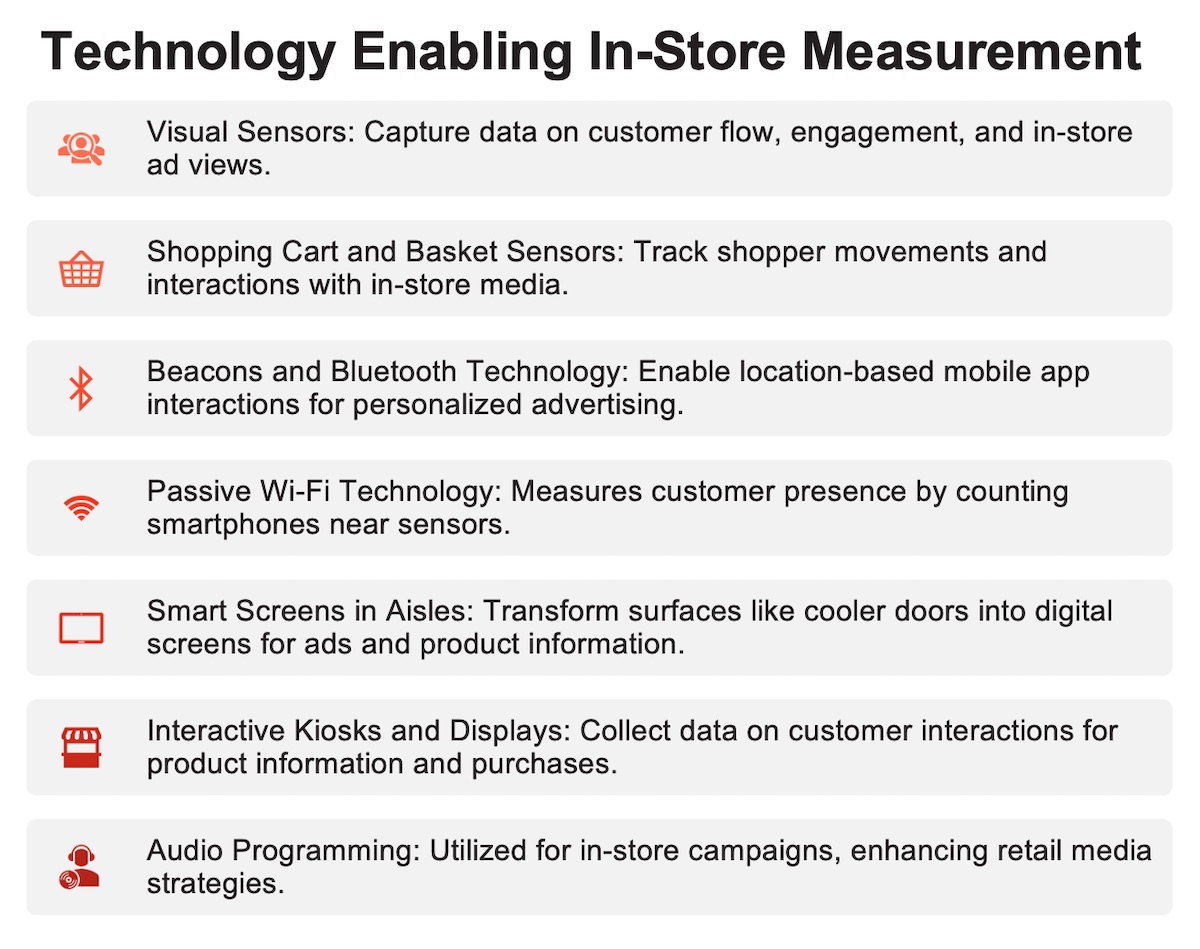

IAB has identified seven types of measurement-enabling technologies for the store, most of which can also serve as media themselves (see chart, below). Kachnowski also noted more basic (and cheaper) tools like QR codes, which brands can also to capture their own data directly when placed on packaging or product displays.

In terms of activation, personalization is, as elsewhere, a key objective. While the potential for shopper-specific messaging — via loyalty program-driven identification —is possible, Hovorka suggested that “one to many at the start” might suffice, as long as the retailer’s closed-loop systems can authenticate behaviors afterward.

Beyond the obvious audience targeting opportunities, marketers should also look to utilize other data signals that will let them address key shopper moments (like the aforementioned snowstorm) and alter their messaging to meet those moments.

And the value of in-store data doesn’t stop with the insights it can provide the brand in question, Kachnowski advised. The aggregation of data across product categories, aisles and stores can provide insights for other brands as well, especially for smaller brands with limited budgets. That concept can even be taken to the industry-wide, best-practice level, with “brands learning from other brands and even retailers learning from other retailers,” she said.

That level of sharing would require retailers to view data more as a conduit for collaboration than another monetizable asset, which makes it incumbent on brands keep demanding as much data as possible. “In-store measurement is already hard. We’re never going to get anywhere” without access to robust data, she said.

Ultimately, the effective deployment of in-store media will go “beyond the ad buy to make sure all of the omnichannel dots are being connected, both for shoppers and for brands,” said Hovorka. Doing that will require marketers to return to one of those retail marketing basics by connecting retail media activity to the retailer merchants who control the rest of the in-store plan, he suggested.