The following analysis is the second in a series of special reports from The Mars Agency providing a comprehensive overview of the key digital marketing opportunities available through five leading retailers in the CPG marketplace.

Generating Traffic Brings More Than Eyeballs.

As we continue our Digital Commerce Roadmap series, we are pleased to direct our focus to “Driving Traffic.”

We previously touched on the critical importance of search, winning the inquiries for your brand, your competitors’ brands, and your category. (If you missed Part 1 of our series, check it out here.) We’ll now shift to driving additional traffic to your brand pages, product detail pages, or custom landing pages on retailer.com sites.

Unlike search, which is focused on keywords, brands can leverage both retailer DSPs (demand side platforms) and third-party sources to create custom audiences and drive people to retailer sites. In this case, I may not care that my target audience isn’t searching for my product right now. Instead, I’ll go out and create my own demand, potentially re-target people, and test any preconceived notions about who my shopper ultimately is.

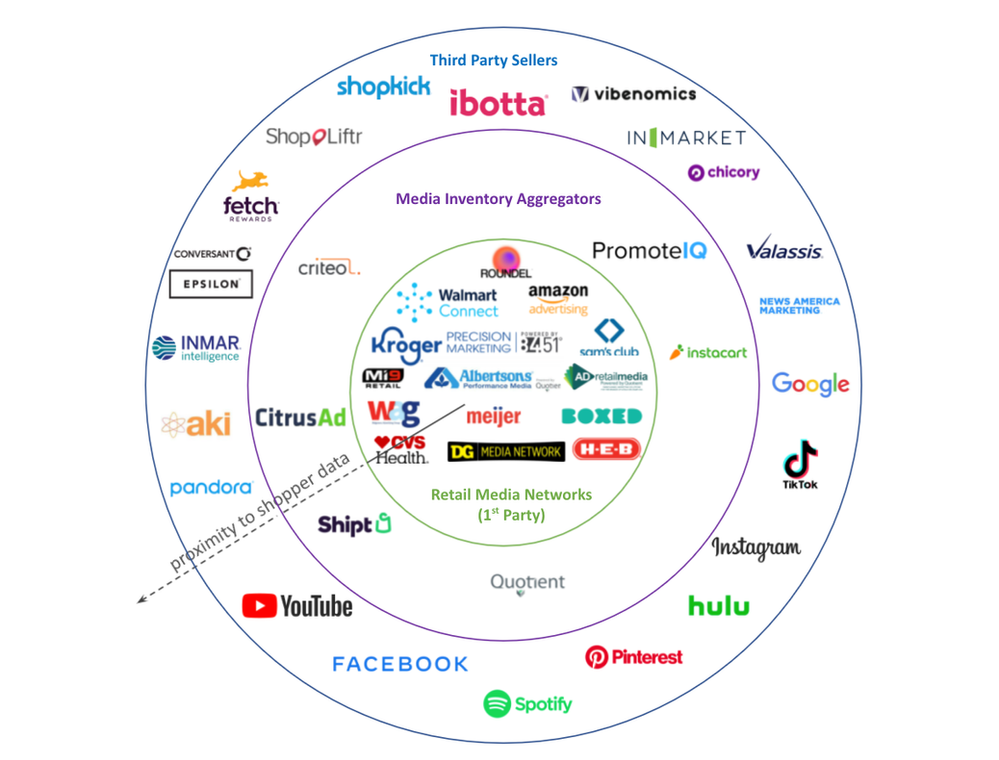

Digital Commerce Landscape

Affiliate programs have long been a thing, and sites like Amazon will reward you for sending them traffic, even if the traffic doesn’t purchase your brand. In fact, recent research from Proftero finds that Amazon recently made changes to its algorithm to weight external traffic more heavily.

This will always be a bit of a catch-22, as brands need to consider the impact of sending one retailer traffic vs. another, the data impact of sending to DTC (direct to consumer) vs. retail, and the margin impact of different channels.

Put simply, this isn’t a one-size-fits-all solution. However, we believe firmly that a strong traffic-driving engine is a key to outsized digital success.

John Willkom, SVP-eCommerce

The Mars Agency

[email protected]

DRIVING TRAFFIC FOR:

KEY CONSIDERATIONS

Amazon’s latest “A10” algorithm places greater emphasis on external traffic. Brands are “rewarded” even if the traffic doesn’t drive purchases.

Shopper research should be leveraged to target specific audience segments and test new segments through Amazon’s DSP, as well as through other external media platforms (social, search, etc.).

Consider Amazon Attribution and the Brand Referral Bonus Program to capture data and recoup costs:

“Amazon Attribution is an advertising and analytics measurement solution that gives marketers insight into how their non-Amazon marketing channels perform on Amazon. … We know there are a number of non-Amazon channels that also play key roles in the shopping journey. With Amazon Attribution measurement, you can gain visibility into how these non-Amazon touch points help customers discover and consider your products on Amazon.”

“The Brand Referral Bonus program credits brands an average of 10% of sales from traffic you have driven to Amazon. The program helps you advertise efficiently by receiving the same bonus for customer purchases of additional products up to 14 days after clicking on the ad … [and] helps you accelerate growth by improving the efficiency of your non-Amazon marketing efforts that drive referral traffic to Amazon.”

FAST FACT:

Amazon enjoys 2.45 billion monthly visits (as of June 2021, per Statista), making it the world’s largest ecommerce site. Ebay was second with 885 million and Walmart third with 410 million.

QUICK TIP:

Ensure you’re ranking for national media search terms to take full advantage of your full-funnel media strategy.

DRIVING TRAFFIC FOR:

KEY CONSIDERATIONS

Running promotions for free delivery, or coupons to drive trial and encourage repeat purchase, can be effective tactics. Delivery promotions typically run for 4-5 weeks and cost the manufacturer $8 per redemption. Coupons are $0.55 per redemption and have an average sales lift of 30-50%.

Hero banners are available by department and typically run on a weekly basis. Average sales lift is 15%, but 30-50% of sales are from new customers.

Instacart has 7+ discovery surfaces, ranging from storefront to departments to post-checkout.

For more insight, read “Cheers to Instacart.”

FAST FACT

On their first Instacart shopping trip, shoppers add about half the items in their basket through search and the other half through category icons.

QUICK TIP

Campaigns include both manual and auto-targeting capabilities, so set minimum bids to $0.15 at the ad group level to minimize spend on auto-targeting.

DRIVING TRAFFIC FOR:

KEY CONSIDERATIONS

Kroger has a variety of targeted on-site ads, as well as the ability to promote through email/direct. This could include magazine placements, events, or loyal customer mailers. Kroger’s emails have 30-50% open rates, with even higher click-through during holiday seasons.

Kroger Precision Marketing (KPM) has partnered with Roku to run OTT (over the top) ads using its first-party data from more than 60 million households and 2,800 stores.

KPM also offers the ability to run influencer ads on social sites like Instagram or promote items through blogs. Other display, audio, and video options are available outside of Kroger.com as well.

Because KPM sits within Kroger’s 84.51 data business, they have the incredibly convenient ability to leverage their own data science to drive more precise targeting.

For more insight, read “Evaluating the New Kroger PMP”

FAST FACT

Ecommerce professionals rate KPM as the top platform in ability to measure ROI, according to Catalyst and Kantar’s “State of Ecommerce Report 2021.” Among the professionals who used Kroger advertising in the prior 12 months, 93% said they were able to measure ROI very well or moderately well.

QUICK TIP

Test-drive the new Kroger PMP, which lets brands tap into KPM’s first-party audience data and closed-loop attribution tools to run campaigns through their own preferred DSP.

DRIVING TRAFFIC FOR:

KEY CONSIDERATIONS

Roundel has multiple advertising vehicles both on Target.com and off-site that utilize Target’ first-party data, which includes purchases, behavior, demographics, and spend-alike models.

The platform’s “Bullseye Network” has more than 150 brand-safe channels to further promote products.

Target Circle lets brands create mass offers or more personalized promotions targeted to the retailer’s roughly 80 million loyalty members.

FAST FACT

Target merchants have vendor income goals for each large manufacturer.

QUICK TIP

Proactively work with your merchant to understand vendor income targets and how Roundel investments can help meet those thresholds.

DRIVING TRAFFIC FOR:

KEY CONSIDERATIONS

Walmart Connect’s new DSP partnership with The Trade Desk lets brands leverage the retailer’s first-party data to better target off-site traffic.

In addition, Walmart has more than 170,000 digital screens within its 4,700+ stores, giving it the unique ability to tie digital ads back to physical locations.

Given the relative newness of Walmart Connect’s ad vehicles, brands should make sure to measure the impact of different ad types and get what they want from their JBP commitments.

For more insight, read “Evaluating the New Walmart DSP”

FAST FACT

89% of shoppers said seeing an ad online reminded them of a product they needed or prompted them to buy something they wanted.

QUICK TIP

Insert advertising KPIs into your JBP Walmart Connect commitments.

Special thanks to Profitero for the foundational insights behind this report.

About the Author

John Willkom is the Head of Ecommerce at The Mars Agency, where he helps brands win in the ever-changing world of connected commerce. John has a passion for brand building and discovering “what’s next,” is an avid sports fan, and accomplished author, having penned the Amazon best-selling book, Walk-On Warrior, in 2018. John and his wife, Allison, have two daughters and call Minneapolis home. He can be reached at [email protected].