By Katherine Barks, The Mars Agency

A growing global practice gives The Mars Agency insights into shopper behavior and the business of commerce across a wide range of countries. Here, the agency’s Toronto-based Retail Solutions team looks at recent consumer trends that are having a significant impact on the Canadian grocery channel.

Even as the pandemic wanes, it appears that many Canadians will continue to stay close to home: 80% of consumers who’ve been working from home during the pandemic would prefer to continue doing so at least half the time home once the pandemic is completely over — and nearly 50% of the ones who feel that way say they’ll look for a new job if forced back into the office, according to the Angus Reid Institute.

Trying to convince them otherwise might prove to be difficult: 71% of Canadian workers feel their productivity at home is good or great, according to Statistics Canada.

Based on their intention to stay home, some of the grocery shopping and food consumption behavior they’ve adopted during the pandemic will continue, most notably:

- Adding new recipes to their meal rotations.

- Looking to grocery stores for food inspiration.

- Expecting more from the grocery shopping experience.

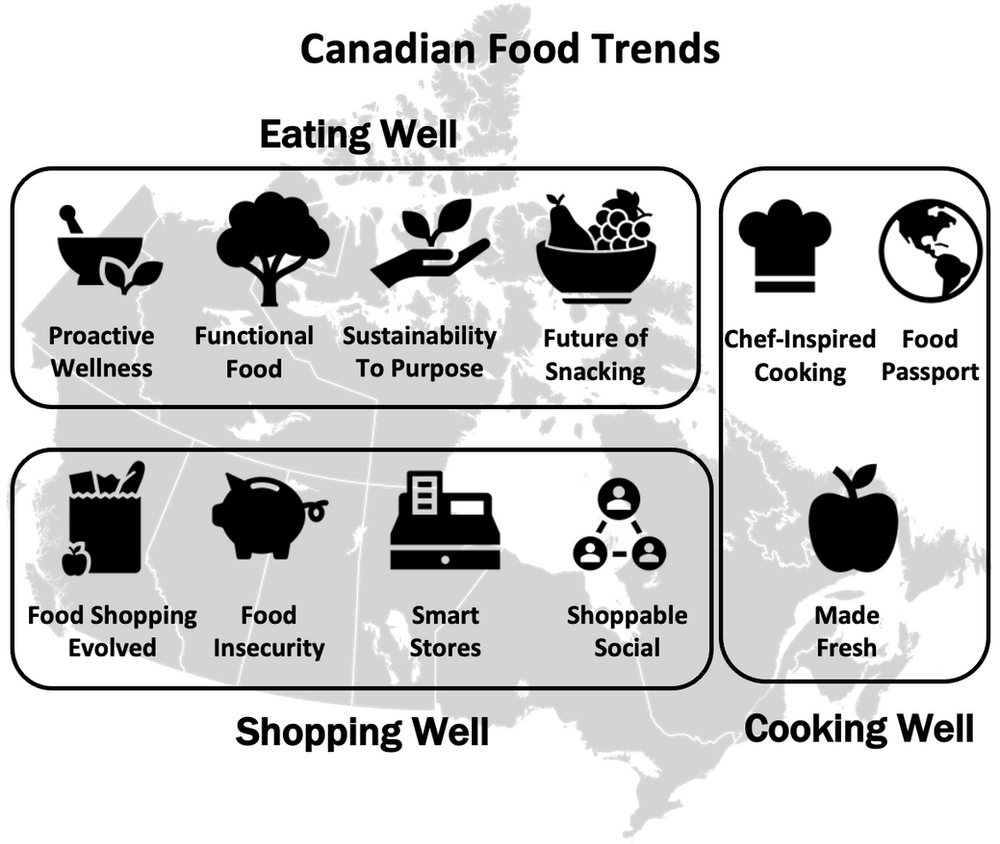

By delving deeper into those three behaviors, The Mars Agency identified 11 eating, cooking and shopping trends that should be top of mind for grocery brands and retailers as they make plans for engaging and influencing post-pandemic Canadian shoppers:

In a series of three articles, we’ll provide a brief overview of each trend, along with one actionable idea for brands to consider.

Part 1: Eating Well

1. Proactive Wellness

Consumers are looking for ways to proactively care for their health, including their mental wellness. They want to know what’s in the food they’re eating, and they’re looking for options with more nutrients. In addition, 64% say they’re more interested in how their diets will affect their overall health and immunity, according to the Nourish Network 2022 Trend Report.

These goals have Canadians examining their food choices more carefully. They aren’t simply adopting new diets or fads, however, but instead are making more informed food choices in an effort to develop more balanced, longer-term healthy habits:

- 44% are trying to consume less meat.

- 43% want locally sourced food.

- 33% look for recognizable ingredients.

- 31% are seeking natural & organic options.

- 35% are seeking sugar-reduced products.

Source: Retail Council of Canada

Women and younger consumers (ages 18-34) are most likely to seek out healthier foods:

- 85% spend more on fresh produce.

- 79% buy plant-based/non-dairy milk.

- 72% buy meat alternatives.

- Source: Retail Council of Canada

However, not all consumers have the money or the time to shop local farmers’ markets or specialty stores, so they expect mainstream grocers to step up their healthy food game.

Shoppers believe their local grocer is an ally for achieving their health & well-being goals.

When it comes staying healthy, 62% of shoppers believe their primary grocery store is on their side. These consumers are hungry for health & wellness information and education, customized dietary choices, and healthcare solutions.

Food is, therefore, a natural gateway for grocers to expand into the health & wellness space by supporting proactive needs. And most grocers know this:

- 75% say health & well-being is the top factor positively impacting sales and profits.

- 71% recognize that shoppers see food as a way to manage or avoid health issues or have a “food as medicine” mindset.

Source: Canadian Grocer

ACTIONABLE IDEA:

Help shoppers find products that support their proactive wellness needs by providing transparency into the quality and sources of your ingredients while emphasizing the healthy benefits of “packaged” foods.

_______________________________________________________________

2. Functional Food

Consumers increasingly are seeking out foods that have a potentially positive effect on health beyond basic nutrition. They’re looking for options that will help them achieve optimal health and reduce the risk of disease.

And the additional time spent at home during the pandemic has made them even more conscious about the food they’re eating.

Among Canadian consumers over the last two years:

- 85% spent more on fresh produce.

- 79% spent more on plant-based milk and non-dairy products.

- 79% spent more on meat alternatives.

- 40% spent LESS on baked desserts, prepared ingredients and hot ready-to-eat meals.

Source: Deloitte, 2021

Many new alternative meat and dairy products are hitting the market, giving consumers more choice than ever before. Interest in these products remains high, driven by the consumer need for choices that are more eco-conscious, healthier — or both.

At the same time, innovation is making plant-based products more diverse and delicious, broadening their appeal.

In fact, their growing popularity is largely driven by flexitarian or “plant curious” consumers who still purchase traditional meat and dairy products. As of July 2021, plant-based foods were a $1.1 billion business in Canada and growing at 17% year over year, according to NielsenIQ.

These health and sustainability concerns will now play a bigger role in shaping the next generation of products: There has been a 59% increase in new plant-based products making relevant claims, according to Canadian Grocer. Future trends also will be influenced by more chefs introducing high-end vegan menus, which will change the general perception about what plant-based foods can be.

ACTIONABLE IDEA:

Establish more partnerships for recipes or meal solutions that incorporate “alternative” ingredients, such as plant-based meat options.

_______________________________________________________________

3. Sustainability to Purpose

A new shopper “demographic” to consider is the “Reducetarian.” First coined by the eponymous nonprofit Reducetarian Foundation, this relatively new term refers to individuals who consciously eat less meat, dairy and eggs to improve their health and protect the environment, but also to “reduce” the need for farmed animals.

Consumers — specifically younger generations — have raised their expectations about how products are sourced and manufactured. They’re making purchase decisions based on which brands have a clearly articulated purpose that they follow.

According to Deloitte:

- 72% of Canadians prefer to shop at food retailers that have strong sustainability or ethical practices.

- 42% of socially conscious shoppers say they’ll buy more locally sourced items going forward, even if they cost a little more.

On the sustainability front, “zero waste” is among the top macro trends for 2022, according to the National Restaurant Association.

ACTIONABLE IDEA:

Create a series of recipes that provide unique ways to repurpose leftovers.

_______________________________________________________________

4. Future of Snacking

During the pandemic, many Canadian consumers re-connected to home life as a haven for refuge, comfort and belonging. At the same time, they’ve gravitated to a less cumbersome, less work-intensive lifestyle, which includes more flexible approaches to eating and drinking.

In this new normal, consumers identify snacks as the 3rd-most important food and beverage “essential,” and 44% attest to eating more snacks since the start of the pandemic, according to Mintel. (Deloitte concurs, finding that 47% of 35–54-year-olds and 51% of 18–34-year-olds do so).

That’s leading to a greater tendency among consumers to stockpile products to make sure they have easily accessible snacking items. In fact, 67% of consumers have increased their spending on the snacking “cupboard,” according to Ipsos.

Beyond fulfilling functional needs like satisfying hunger or thirst, filling the gap between meals or providing a convenient meal solution, snacking choices are increasingly driven by “mood needs” such as comfort, stress relief and relaxation.

Although increased snacking at home has inspired more consumers to view fresh produce as an option, the popularity of old standbys like potato chips remain strong. While 80% of consumers are looking for healthy snacking alternatives, they do still want their choices to “taste good,” Mintel finds.

Naturally, purchase trends in the snacks category mirror what’s occurred everywhere else: 73% of Canadians ordered snacks online in 2021, and more than 50% say they will continue doing so in 2022, according to Mintel.

ACTIONABLE IDEA:

Make sure to communicate the emotional benefits of your snack brands.

Part 2: Cooking Well

Part 3: Shopping Well

About the Author

Katherine Barks is VP-Strategy within the Retail Solutions team at The Mars Agency. She is a business strategist with 25+ years of diverse experience across the many facets of strategy, including consumer/ shopper behavior research, channel and category insight, retail strategy, customer experience design, and measurement best practice. A highly regarded marketer in North America, she has worked with many tier-one CPG clients such as Kimberly-Clark, S.C. Johnson, Unilever, Diageo, Heineken, Pfizer, Pepsi, Campbell Soup Company and General Mills.

In her current role, Katherine is focused on supporting retail strategists and retailer clients including Walmart Canada, Big Y and Hudson’s Bay.