The act of shopping — and buying — through social media gives brands and retailers new avenues for growing the bottom line.

By Julia Miller, The Mars Agency

After experiencing a breakthrough year in 2021, Social Commerce is one of the hottest trends in marketing as we enter 2022. As shopping behavior continues to evolve throughout the pandemic and beyond, consumers are turning to purchase-enabling social channels that let them shop by acting on recommendations from people they trust.

Brands and retailers are responding to these changes in shopper behavior by re-prioritizing their marketing investments and embracing new technologies that bridge the gap between digital content and commerce — making social networks an ideal channel on which to focus their attention.

In fact, 80% of brands rate social as their No. 1 marketing channel post-pandemic, according to Hubspot — which also found that 81% of consumers claim to “frequently” buy items they see on social media. Those two have Accenture forecasting that social commerce spending will more than double to $99 billion by 2025.

1. The Overnight E-comm Boom

The rapid acceleration of e-commerce in the past 18 months forced brands and retailers to pivot instantly to meet the pandemic-induced demand for online grocery shopping. As Kroger CEO Rodney McMullen stated last fall, “We’ve always believed that digital is going to continue to grow in the supermarket business. If you look at COVID,

it basically accelerated three years of transition in two weeks.”

2. The Steady Shift to Social Use

Similarly, the pandemic sped up what had been an ongoing shift in media consumption, with stay-at-home consumers spending even more time than anticipated on digital and social channels in 2021. In particular, time spent on social media by adults continues to gain traction, rising almost 10% in 2021 to 1:35 hours per day. TikTok has enjoyed the most growth (+18.3%), and now has 78.7 million U.S. users (who spend more time there than on Facebook).

3. Makers Are Making More Money

Meanwhile, the rise of content creators has sparked an evolution in how conversations happen on social media and, in turn, how brands are engaging with consumers. Creators are the stars of social media, formerly thought of as “influencers” but now more influential than ever due to the aforementioned changes in media consumption.

In this new economy, creators produce sharable content in various forms (livestreams, recorded short video, static posts, blog posts, etc.) that is distributed on the platform they‘re associated with — often by partnering with a brand to endorse its products or services for a fee. Platforms such as TikTok, Snapchat and YouTube have established massive “creator funds” to incentivize big-name social stars to use their platforms, setting aside hundreds of millions of dollars for the top creators:

- Snapchat divvies up $1 million daily to top creators.

- TikTok has a $200 million creator fund.

- Instagram offered popular TikTok creators monetary incentives to switch over to the Reels platform it launched in summer 2020.

For these reasons, the spectrum of tools across which social commerce is executed has also been expanding to encompass a wider range of sophistication. These enhanced capabilities from social platforms and other commerce enablers (see the chart below), coupled with the proliferation of content creators, has allowed brands and retailers to leverage social as a key shopper touchpoint across the full purchase funnel.

Here’s a quick look at how brands and retailers are effectively using each of these social media tools to achieve a variety of marketing objectives by engaging with consumers and shoppers.

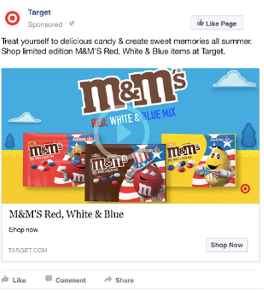

Add to Cart

As the major social media platforms have enhanced their on-platform commerce capabilities with large investments in shoppable content. At the same time, third-party technology companies have enhanced their tools to further streamline social commerce, creating a seamless experience between upper-funnel content and lower-funnel conversion.

These enablers can be placed on any type of digital media to drive consumers from awareness through conversion in a single click.

Examples include co-branded offers for instant savings and shoppable recipes that let viewers immediately add ingredients to a cart.

______

Shopper Influencers

Shopper Influencers

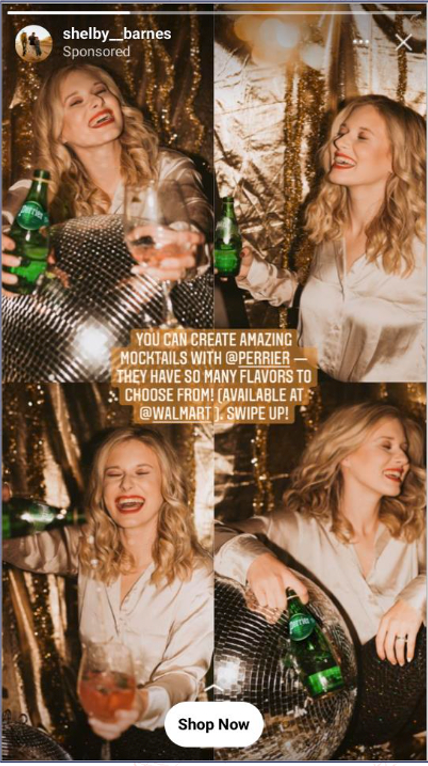

The relevant content produced by social influencers has evolved considerably from static or simple video posts to shoppable content and livestream experiences.

Influencers often play a key role in driving awareness for new items through curated “Instagrammable” photos and videos or even impromptu livestream shout-outs endorsing a brand. And brands no longer need influencers with large followings, either: they’re now partnering with micro-influencers to develop more authentic content for their niche audiences, thereby using paid social media to reach new shoppers.

For instance, Perrier joined forces with shopper influencers on Instagram to drive awareness of flavors and inspire new usage occasions with shoppable mocktail recipes for purchase at Walmart.

Lower-funnel partners are getting in the game by offering access to shopper influencers and robust audience targeting opportunities that use purchase and intent data from sources such as coupon downloads or load-to-card and offer redemptions.

______

Brands and retailers are leveraging Pinterest’s robust lower-funnel keyword targeting to reach shoppers with purchase intent. The platform’s pins contain metadata and are formatted to let “Pinners” know they’re shoppable. They contain product title and description, pricing info and availability.

Brand-promoted content can drive both inspiration and conversion through the ability to add recipe ingredients to the shopping cart at one of multiple national retailers.

Retailer-promoted content allows shoppers to add products to that chain’s cart in one click.

______

Social Giveaways & Sweeps

Even age-old promotional tactics like games, contests and sweepstakes can be refreshed by reaching consumers through social channels where they’re already engaged.

Social giveaways s and purchase-verified instant-win promotions can be used to drive household penetration while building brand equity.

______

Data-backed Social Sampling

Social has also played a role in the evolution of product sampling, which largely shifted online at the beginning of the pandemic but has continued to progress this year toward a more efficient, data-first model.

There has been a rise recently in the number of data-backed social sampling partners offering brands the ability to gain insights, data and reviews from consumers in exchange for shipping free products to their homes.

This format has been popular among CPGs who historically viewed sampling as an in-store handout deriving little to no feedback from shoppers.

This trend has also extended to voice sampling, where CPGs can drive trial and awareness for new products over social while gaining valuable CRM data from consumers who opt in as they request samples through their smart speakers.

______

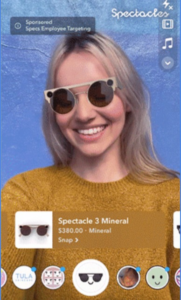

Shoppable AR Experiences

Shoppable AR Experiences

Another commerce driver whose usage we expect to see grow is shoppable augmented reality (AR) experiences.

In fact, Snapchat recently launched a catalog-powered “Shopping Lenses” tool that facilitates one-tap buying from a lens product card (at right).

This removes the barrier of building the AR experience for brands while facilitating a more engaging, frictionless experience for shoppers.

In an extremely unique effort last Halloween, we worked with our clients at Mars Wrigley to partner with Snapchat and home delivery service DoorDash to reinvent the vending machine, leveraging commerce AR to launch a first-to-market opportunity. The interactive experience invited “Snapchatters” to buy candy from a virtual vending machine and have it delivered in less than an hour in five pilot markets.

Augmented reality is changing the way we shop, learn and play. AR can not only add uniquely entertaining elements to the brand engagement, it also can give social shoppers the convenience and confidence they need to make impulse purchases. And consumers are open to the idea, as was illustrated when TikTok influencers coined the hashtag, “#TikTokMadeMeBuyIt,” in recognition of the platform’s ability to convince people to buy.

______

Pop-Up AR Seasonal Shops

Taking AR activation one step farther, Snapchat continues to invest heavily in commerce AR, using the camera as the new storefront.

Brands and retailers are getting in on the action, with Coca-Cola and Walmart opening holiday AR stores live on Snapchat last December.

All these executions illustrate how the AR platform has evolved beyond offering fun and engagement to layer on the opportunity to drive impulse purchase with commerce enablers embedded into the experience.

______

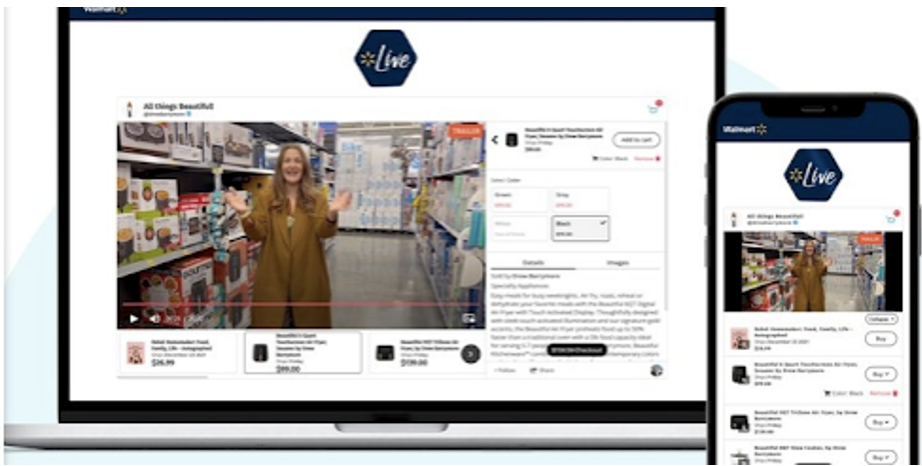

Livestream Shopping Experiences

Retailers are getting in the game, too. Walmart recently announced a new partnership with social network TalkShopLive that will let shoppers buy directly from livestream video integrated into the retailer’s platforms with an API.

This partnership represents Walmart’s latest move to bridge the gap between content and commerce.

______

What’s the Key Takeaway?

Trends in the Social Commerce space will continue to evolve quickly and unexpectedly. Brands that are open to testing new ways to reach shoppers on digital and social platforms through AR, VR and influencers — while optimizing, gaining learnings and gathering insights — will be better positioned to succeed in this new area of connected commerce.

Implications for Brands:

● Social commerce should be viewed as a full-funnel, through-the-line opportunity developed to meet specific campaign objectives.

● Seek out first-to-market opportunities with your agency partners that will foster a learning agenda with hypotheses, benchmarks and KPIs.

● The value of real-time insights and measurement available through social marketing uncovers a wealth of intelligence far sooner than traditional activity.

About the Author

As Group VP-Media Strategy at The Mars Agency, Julia Miller works with CPGs to elevate their shopper marketing and consumer promotions go-to-market strategies through innovative, contextual commerce solutions.

She has over 15 years of experience working with leading CPGs including Mars Inc., Nestle Waters, Henkel and Colgate-Palmolive.