By Jack Lindberg, The Mars Agency

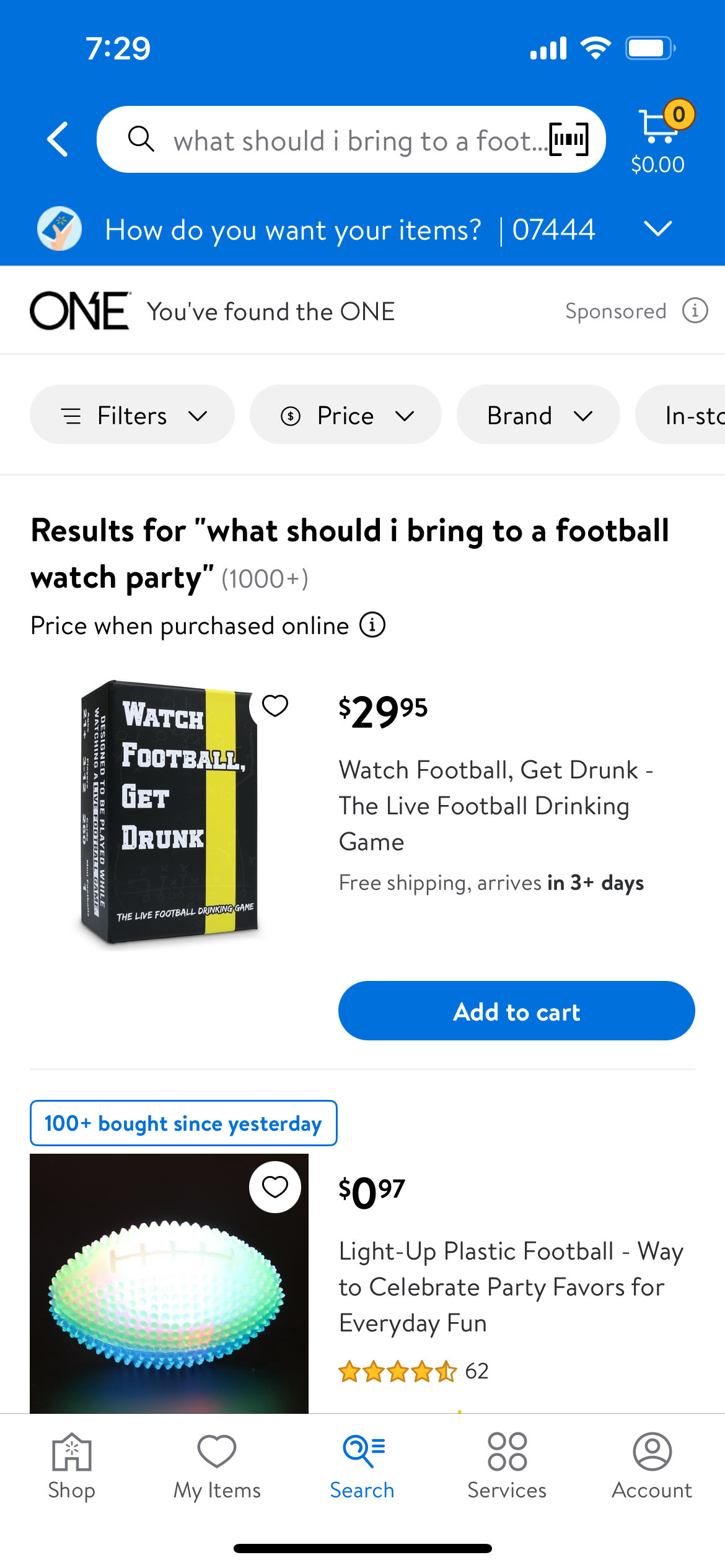

In an innovative leap forward, Amazon and Walmart have each introduced a generative AI-driven digital shopping experience.

Amazon has given its new search tool the memorable and corporately relevant name of Rufus; Walmart has less-creatively rolled out an unnamed solution developed in partnership with Microsoft Azure’s OpenAI platform.

Together, they mark a pivotal moment for brands and marketing agencies — who must now hustle to adapt to these advanced retail landscapes.

Why? Because paid search accounts for the majority of retail media spending (not to mention 11% of all digital ad spending), and the two largest, most important retail media networks have just thrown a dramatic new wrinkle into the very nature of product search.

In short, Amazon and Walmart are transforming product search from a self-guided tour through the digital shelf to a curated concierge service.

This sudden shift to AI-powered commerce has left many brands in the lurch, unprepared for the transformative change now at their doorstep. However, a deeper understanding of the large language models (LLMs) that drive these new search tools could deliver a beacon of hope, offering brands a way to not just catch up with these technologies but to excel in the new era of search that is emerging.

Comprehending the strategic approaches Amazon and Walmart appear to be undertaking will be crucial to future brand success. And understanding the methodology behind the tools will give brands a clearer picture of how to interact with them — knowing how that concierge gets his information will help brands figure out how to climb to the top of his list.

The Mechanics of LLMs

Large language models are a special type of AI algorithm that uses deep learning techniques to mine massive data sets in order to understand, summarize, generate, and predict new content (definition courtesy of TechTarget).

The genAI landscape offers various methods of tailoring LLMs to perform specific tasks like generating search results. Each method offers a unique set of benefits and considerations for retailers like Amazon and Walmart.

Deciding which LLM method to deploy hinges on various factors: the desired accuracy of the results, the complexity of implementation, and the total cost of ownership. Having the flexibility to adapt to future change is also critical, given the rapid advancements in AI technology taking place.

Neither Walmart nor Amazon have yet offered a peek behind the curtain about which methods they’re employing, but we can make some inferences based on the knowledge we have about each company.

Not surprisingly, Amazon has created its own concierge. Rufus likely harnesses the existing power of Amazon Web Services’ Bedrock and Titan genAI tools, which suggests a commitment to creating a highly customized, accurate shopping experience informed by vast amounts of retail data and consumer behavior insights.

Walmart, meanwhile, has hired a concierge. Through its partnership with Microsoft Azure, it’s potentially using the GPT-3.5 Turbo OpenAI model and seems to be focused on speed of results, along with operational efficiency and cost-effectiveness. This approach would also allow Walmart to quickly adapt the model to changing inventories and shopper preferences while maintaining a high level of responsiveness and accuracy.

Implications for Brands

As more details come to light, understanding the nuances in strategy behind Rufus and Walmart’s solution should give brands actionable insights. But while we’re still not quite sure how these two concierges are generating their recommendations, there are a few things brands can start doing immediately:

- Use and optimize all of the content fields in your product page setup. The more content you provide, the more data will be available to feed the search results algorithm.

- Pay close attention to your product reviews. They carry vast amounts of information about the user experience that will likely play a key role in search results going forward.

- Reset your expectations. The chances of more than one product in your brand portfolio making it to the top of search results now will be very slim. Expect your overall page traffic to narrow.

While they’re trying to crack the code on future organic search — and waiting to see what unique paid search opportunities might arise — brands should also consider how to leverage similar genAI techniques to enhance their own online presence, customer service, and product discovery processes. Whatever strategy you ultimately employ, the basic objective should be clear: adapt and innovate.

The evolution of generative AI for retail opens up a world of possibilities for brands willing to explore and understand these technologies. By aligning their strategies with the advancements made by leaders like Amazon and Walmart, brands can not only stay competitive but can also help reimagine the shopping experience for their customers.

About the Author

Jack Lindberg is Director of Media Insights & Analytics at The Mars Agency, where he is responsible for leading the Amazon/Amazon Marketing Cloud analytics and the data clean room practice. Prior to joining The Mars Agency, Lindberg was a senior product manager at Pacvue, where he helped build the commerce accelerator’s advertising product. Contact him at [email protected].