The following analysis is the third in a four-part “Digital Commerce Roadmap” series that The Mars Agency publishes annually to provide a comprehensive overview of key digital marketing opportunities available across leading retailers.

Read Part 1: Winning Organic Search

Read Part 2: Driving Traffic to Retailer Websites

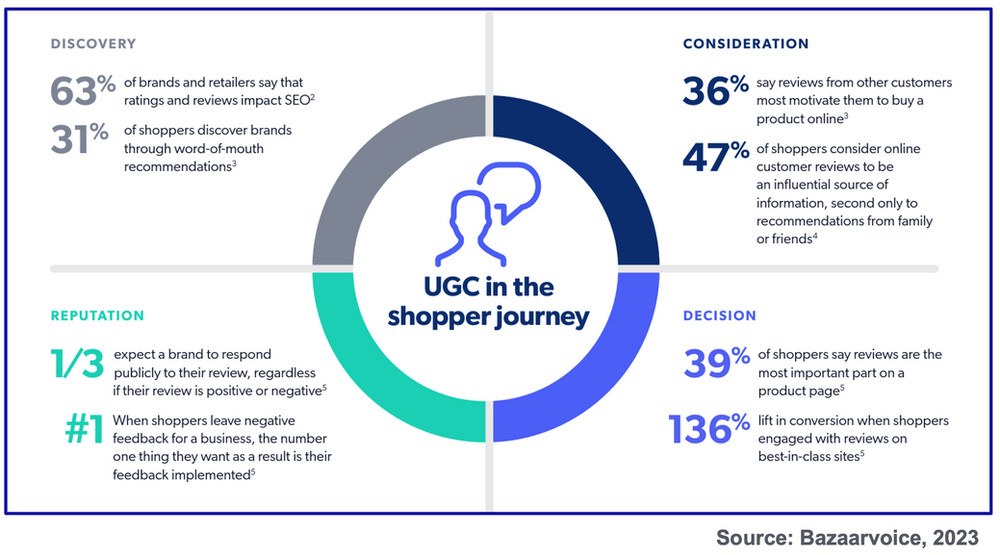

In today’s digitally driven retail landscape, shoppers rely heavily on product reviews from their peers to make informed purchase decisions.

User generated content (UGC) provider Bazaarvoice has conducted research with shoppers to help brands better understand how much they value ratings and reviews to guide them through all stages of the buying process.

Retailers already understand this. They have plenty of data proving how both the quality and quantity of product reviews can significantly improve conversion rates among their shoppers.

Securing reviews for your new products, therefore, is standard practice for any launch plan — as is supporting products with low review counts on a frequent basis and consistently refreshing the review libraries of your top sellers. And there are plenty of resources available to help brands make this happen.

In addition to third-party review platforms like Bazaarvoice and PowerReviews, most retailers have their own programs for driving product trial and reviews. In this article, we’ll look at strategies for the ratings and reviews at six leading retailers to help brands understand how best to optimize their activity on each platform.

RATINGS & REVIEWS ON:

For many consumers, Amazon has become a go-to destination for pre-shopping product research. Reading reviews on Amazon is an important step toward making purchase decisions — regardless of where they end up buying the product. A recent Cleveland Research Company study found that nearly 60% of Amazon shoppers consider rating and reviews to be a key feature of the retailer’s Product Display Page (PDP).

Brand and product managers have known this for a long time, but the typically low response rate to emails requesting post-purchase reviews — 1% to 2% — is a common challenge. To address this, many managers have turned to automation tools to increase the number of review requests sent out in hopes of increasing the response. While this approach may yield more reviews, it doesn’t speak to their quality or authenticity.

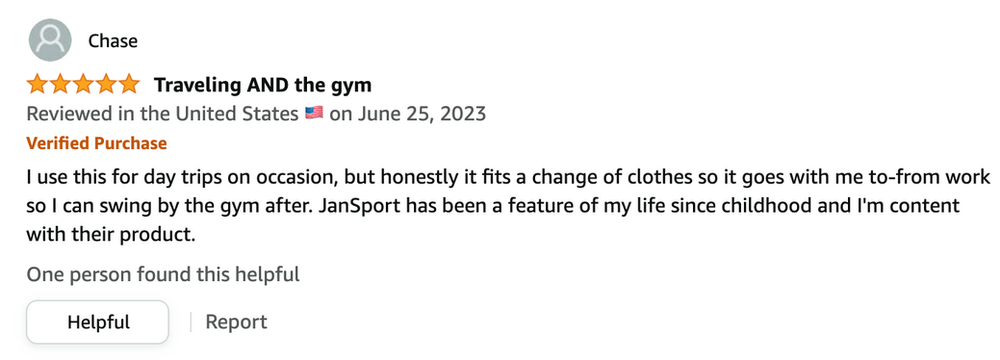

It’s worth noting that the review section on Amazon is now titled, “Top reviews from [insert Country here].” These “top” reviews are determined by Amazon’s standards and, unlike their previous practice, may not reflect the most recent opinions provided by customers. Instead, they typically are reviews that received the highest number of “helpful” votes, and they often include photos or videos. So if you don’t get a response when asking customers to leave a review, encourage them to vote for helpful positive reviews is also another option.

Amazon has its own program called Vine that can also help brands solicit authentic reviews. The invitation-only program selects the most insightful reviewers in the Amazon store to serve as “Vine Voices.” Amazon ships them products to them at no cost to get their honest, unbiased opinions.

This year, Vine is available free to brand-registered third-party (3P) marketplace sellers, although first-party (1P) sellers must pay a fee to join. However, participation in the program does not guarantee that product recipients will leave reviews. What’s more, some participating marketers feel that Vine members may tend to be more critical — possibly because they now perceive leaving reviews as being their “job.” And the last thing a brand wants is to pay for negative reviews.

Monitoring negative feedback is essential, and brand managers should report to Amazon any bad reviews related to the retailer’s own logistical issues. By reporting these reviews quickly, steps can be taken to remove them from the product page and prevent them from impacting future shopper perception.

For brands selling products on Amazon in multiple countries, it’s crucial for brand managers to maintain regular communication with regional teams to monitor negative reviews across markets, since Amazon is now cross-posting reviews from different regions. This will help identify and address potential issues and minimize negative shopper experiences.

One final note: Amazon removed the functionality that let brands reply directly to negative reviews back in 2020 and has long required all brand communications to route through their messaging tool; providing direct phone numbers or email addresses to facilitate follow-up conversations is prohibited — because, to Amazon, the shopper is their customer.

Overall, understanding the significance of reviews, leveraging programs like Vine effectively, and staying proactive in managing feedback can help marketers build a positive brand image and improve the shopping experience for Amazon customers.

RATINGS & REVIEWS ON:

Following in the footsteps of other retailer websites, Instacart now also presents product reviews and ratings on its platform.

Instacart’s process for review integration operates in the same way as other PDP content syndication. If you sell products on Instacart but haven’t taken the initiative to directly upload content, all PDP content — including reviews — is sourced from the websites of the delivery service’s retailer partners.

So if you don’t have a workflow for direct content syndication to Instacart, maintaining positive product reviews on each retailer’s website becomes even more essential. But when a brand works directly with Instacart, the uploaded content will override the retailer.com content and reviews aren’t automatically syndicated from retailer.com sites.

In this situation, we recommend that brands create content directly for Instacart if possible. Most big box retailers have their own distinct fulfillment and delivery services and might, therefore, generate reviews unrelated to Instacart. It’s therefore beneficial for brands to capitalize on Instacart’s capabilities by providing unique content tailored to the mindset of on-demand shoppers, for whom the most important aspects are product availability, content completeness, and price.

RATINGS & REVIEWS ON:

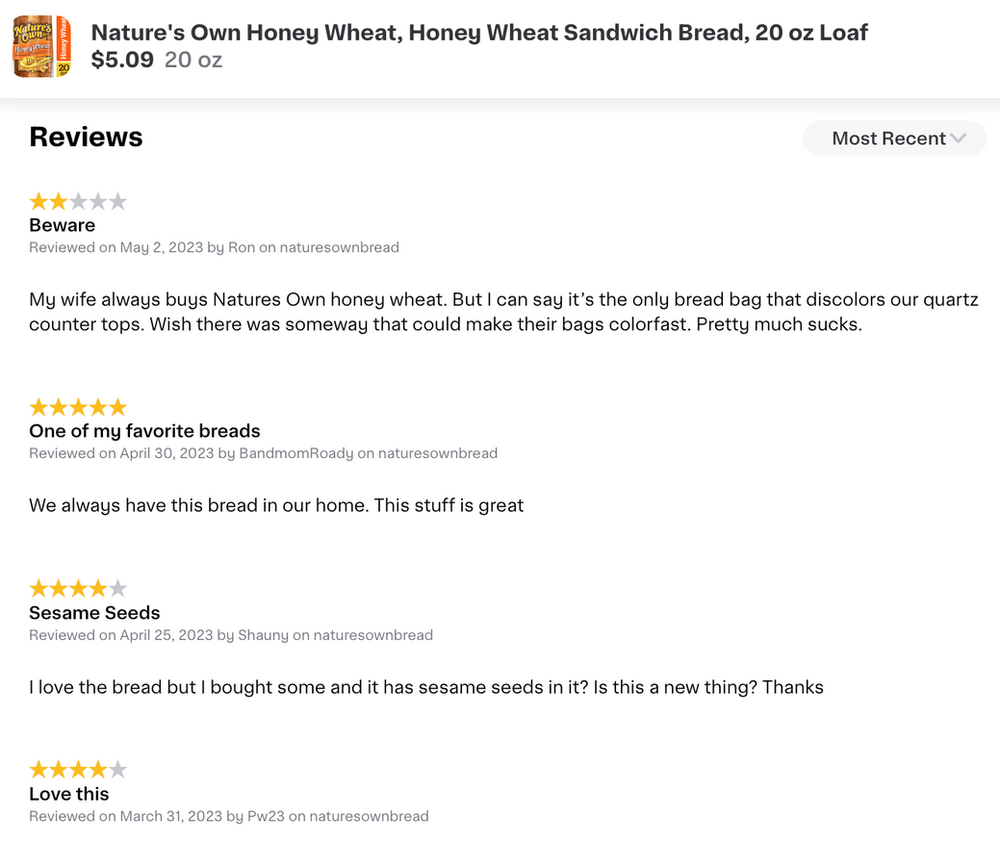

Kroger takes a unique approach to product reviews. Unlike other platforms, Kroger doesn’t let customers post reviews on any of the websites in its 22-banner chain portfolio. But that doesn’t mean that reviews are absent from the ecosystem; instead, Kroger collects reviews from various external sources to provide customers with this valuable information — and brands can get involved directly.

That’s because one of Kroger’s review sources is a brand’s own website. By curating a collection of customer testimonials and positive feedback, brands can provide Kroger with a reliable and controlled source of positive reviews that will help guide the purchase decisions of customers conducting searches.

Additionally, brands can utilize 3P review syndication tools such as Bazaarvoice and its sister company, Influenster. Most of these tools are supported by a service provider that sends out product samples to collect reviews on behalf of brands. Their functionality then lets brands distribute the resulting reviews to various platforms, including Kroger. By leveraging these syndication tools, brands can ensure that positive reviews will reach a broader audience. This approach not only enhances brand visibility, but also helps build trust and credibility among potential customers.

RATINGS & REVIEWS ON:

Between 2% and 5% of Target’s online purchases generate organic reviews, which is slightly higher than other retailers. So if you’re struggling to get reviews, Target could be a good place to focus some of your solicitation resources.

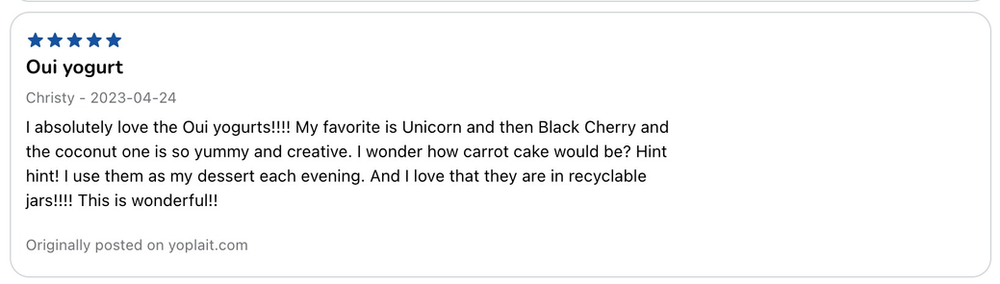

Target also has actively set up its website to answer the current demand among shoppers for UGC, and photos and videos from product reviews are an important element of that. Bazaarvoice (which is one of Target’s review syndication partners), found that over half of shoppers prefer a mix of UGC and professional photography on PDPs to assist them in evaluating new products. In fact, 80% of consumers now consider user-generated photos to be more valuable than brand-provided content — a remarkable increase from 44% who made that claim in 2016, according to PowerReviews, another Target syndication partner.

Target has responded, and currently is the only retailer that places customer-supplied review photos right alongside brand-provided imagery. This move underscores the growing influence of authentic consumer experiences and visuals on purchase decisions.

But remember that consumer appreciation for user-generated photos and videos can vary across product categories. PowerReviews finds that UGC is most important in categories like appliances (for 63% of consumers), home and garden (62%), and health & beauty (60%). Brands in these categories should always encourage their shoppers to include photos or videos in the reviews they write on Target.com.

By embracing the authenticity and value that UGC provides, Target can enhance the overall shopping journey for their customers. Incorporating UGC in a strategic, moderated manner will enable the retailer to build trust, foster engagement, and empower shoppers to make more confident, informed purchase decisions.

RATINGS & REVIEWS ON:

Ratings and reviews play an especially vital role in shaping customer perception and influencing purchase decisions in the realm of machinery and tools at The Home Depot. McKinsey has found that consumers are more discerning when buying durables and therefore less likely to consider products with low ratings. The higher costs — not to mention potential risks — associated with making poor choices in these categories inspire customers to prioritize highly rated options.

According to Cleveland Research Company, DIY project shoppers scour product reviews everywhere: 54% on Google, 49% on Amazon, and 41% on HomeDepot.com. For your brand to stand out at this retailer, you’ll need to keep tabs on reviews across these and other sources.

Home Depot lets shoppers freely write reviews about the products they purchase. Although Amazon has removed the functionality that let brands reply to negative reviews, Home Depot still allows it, even letting brands leave contact numbers for follow-up conversations. On HomeDepot.com, therefore, it’s worthwhile and important to constantly monitor negative reviews and reply in a timely manner.

The retailer also has its own Home Depot Reviewer Program, in which enlisted customers are given 60 days to review products they’ve been sent. Participants are compensated with a small incentive (often a gift card). For now, Home Depot is selecting the products featured in the program. So if you would like to participate more frequently, consider having a conversation with your Home Depot Brand Advocate to see how your brand might be able to gain additional opportunities.

RATINGS & REVIEWS ON:

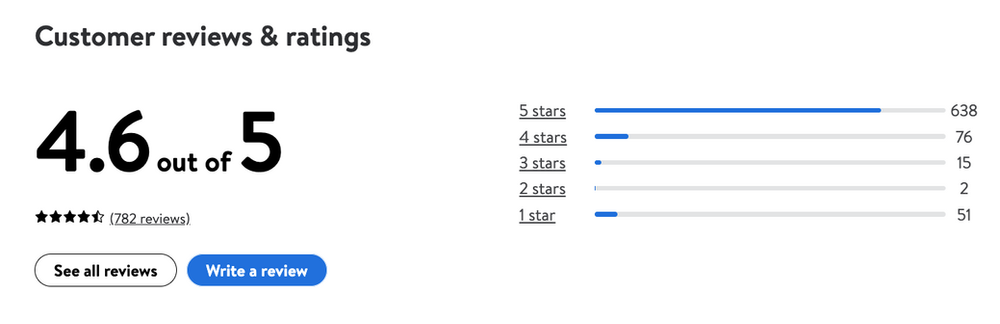

Walmart continues striving to increase its ecommerce market share and recognizes the impact of reviews on conversion. The retailer encourages brands to accumulate a minimum of 20 reviews for their products to enhance appeal and credibility.

Research from advertising solution provider Pacvue has found that sales and conversion rates begin to plateau once a product reaches 21 reviews. So the optimal time to initiate ad support for a product is after it has amassed 21 reviews. At this stage, the product has garnered sufficient social credibility through the reviews, which will increase its appeal to potential customers. So strategically timing the ad support will allow brands to capitalize on the combined influence of reviews and advertising.

Another important consideration when working with Walmart is the Listing Quality Score it devises (using algorithms) for all PDPs and shares with brands. Depending on the geographic market, ratings and reviews can have a weight of 8% to 10% of your total score. So make sure you solicit enough reviews for your products to achieve a higher content score. From our experience, having the best possible content score is an ideal way for brands to gain greater partnership support and more test & learn opportunities on Walmart.com.

____________

The Mars Agency’s Ecommerce team knows that succeeding through online marketplaces requires quality content, winning the search algorithm, and a whole lot more. Our experts take clients to a new level of success by providing end-to-end business management, including operations, advertising, and digital shelf optimization. Using the agency’s proprietary data platform, our Digital Shelf Shop creates, enhances, and optimizes client activity across the ecommerce landscape, helping them beat the competition and convert shoppers.

For more information, contact Kristin Wall, VP-Ecommerce.